Authors

Summary

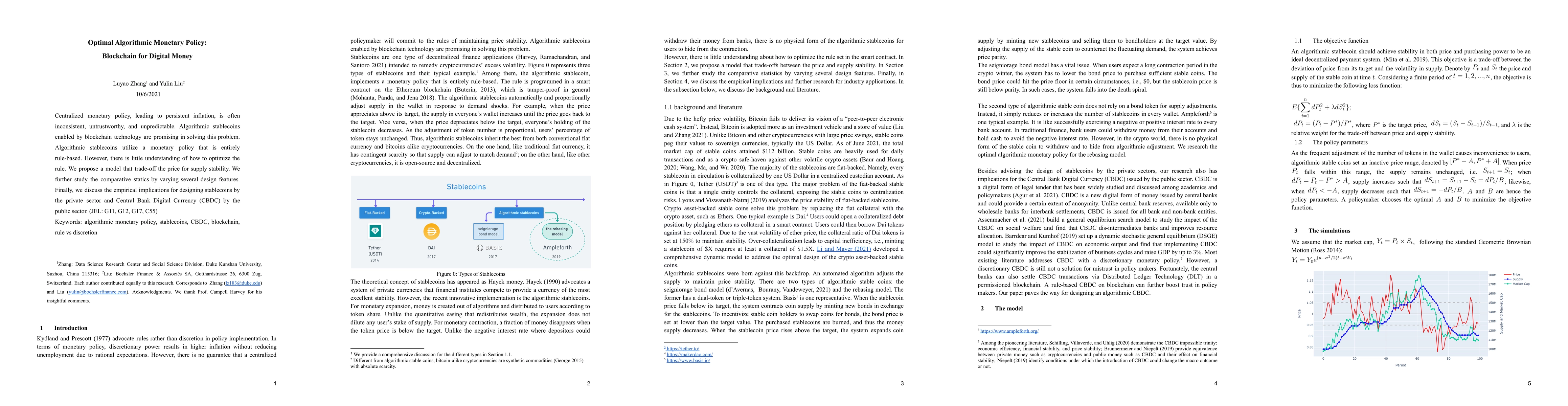

Centralized monetary policy, leading to persistent inflation, is often inconsistent, untrustworthy, and unpredictable. Algorithmic stablecoins enabled by blockchain technology are promising in solving this problem. Algorithmic stablecoins utilize a monetary policy that is entirely rule-based. However, there is little understanding of how to optimize the rule. We propose a model that trade-off the price for supply stability. We further study the comparative statics by varying several design features. Finally, we discuss the empirical implications for designing stablecoins by the private sector and Central Bank Digital Currency (CBDC) by the public sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersZero-Knowledge Optimal Monetary Policy under Stochastic Dominance

David Cerezo Sánchez

Financial constraints, risk sharing, and optimal monetary policy

Aliaksandr Zaretski

| Title | Authors | Year | Actions |

|---|

Comments (0)