Summary

We study the problem of designing revenue-maximizing auctions for allocating multiple goods to flexible consumers. In our model, each consumer is interested in a subset of goods known as its flexibility set and wants to consume one good from this set. A consumer's flexibility set and its utility from consuming a good from its flexibility set are its private information. We focus on the case of nested flexibility sets --- each consumer's flexibility set can be one of $k$ nested sets. We provide several examples where such nested flexibility sets may arise. We characterize the allocation rule for an incentive compatible, individually rational and revenue-maximizing auction as the solution to an integer program. The corresponding payment rule is described by an integral equation. We then leverage the nestedness of flexibility sets to simplify the optimal auction and provide a complete characterization of allocations and payments in terms of simple thresholds.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper studies the problem of designing revenue-maximizing auctions for allocating multiple goods to flexible consumers, focusing on nested flexibility sets where each consumer's flexibility set can be one of k nested sets.

Key Results

- The allocation rule for an incentive-compatible, individually rational, and revenue-maximizing auction is characterized as the solution to an integer program.

- The corresponding payment rule is described by an integral equation.

- The nestedness of flexibility sets is leveraged to simplify the optimal auction, providing a complete characterization of allocations and payments in terms of simple thresholds.

- The mechanism is shown to be ex-post individually rational and Bayesian incentive compatible.

Significance

This research contributes to auction theory by providing a simplified optimal auction design for flexible consumers, which can be applied in various domains such as energy markets and spectrum allocation.

Technical Contribution

The paper characterizes the optimal auction design using integer programming and integral equations, simplifying the solution via nested flexibility sets.

Novelty

The approach leverages the nested structure of flexibility sets to simplify the optimal auction design, providing a more computationally tractable solution compared to previous methods.

Limitations

- The model assumes private information about consumers' flexibility sets and utility functions.

- The analysis does not directly address dynamic settings or time-varying resources.

Future Work

- Investigating extensions to dynamic settings where customer and/or goods sets change over time.

- Exploring applications in other domains, such as cloud computing resource allocation.

Paper Details

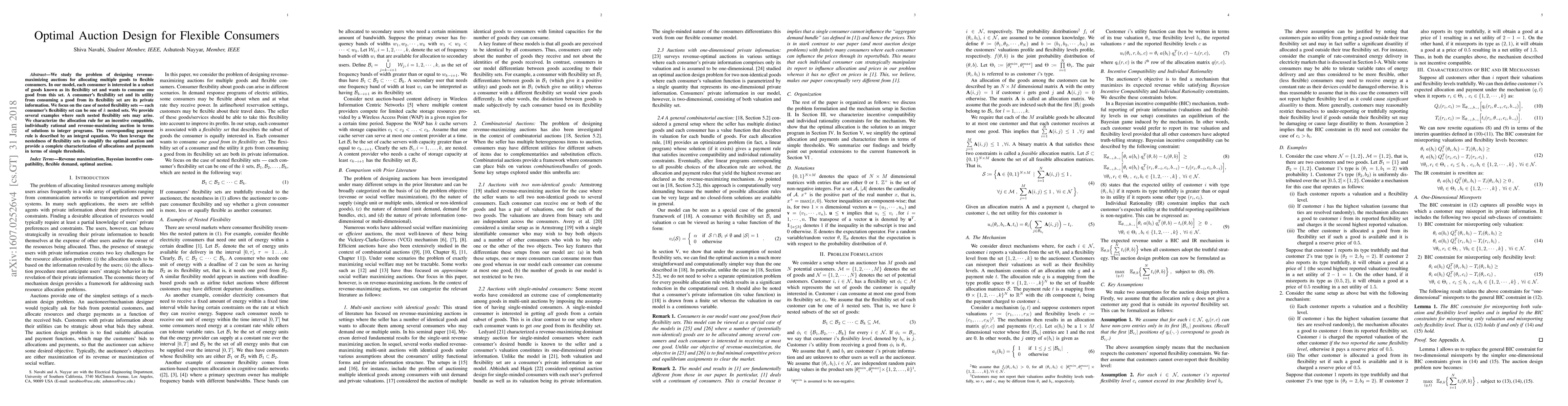

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Auction Design with Flexible Royalty Payments

Ian Ball, Teemu Pekkarinen

| Title | Authors | Year | Actions |

|---|

Comments (0)