Summary

We show that the multiplicative weight update method provides a simple recipe for designing and analyzing optimal Bayesian Incentive Compatible (BIC) auctions, and reduces the time complexity of the problem to pseudo-polynomial in parameters that depend on single agent instead of depending on the size of the joint type space. We use this framework to design computationally efficient optimal auctions that satisfy ex-post Individual Rationality in the presence of constraints such as (hard, private) budgets and envy-freeness. We also design optimal auctions when buyers and a seller's utility functions are non-linear. Scenarios with such functions include (a) auctions with "quitting rights", (b) cost to borrow money beyond budget, (c) a seller's and buyers' risk aversion. Finally, we show how our framework also yields optimal auctions for variety of auction settings considered in Cai et al, Alaei et al, albeit with pseudo-polynomial running times.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

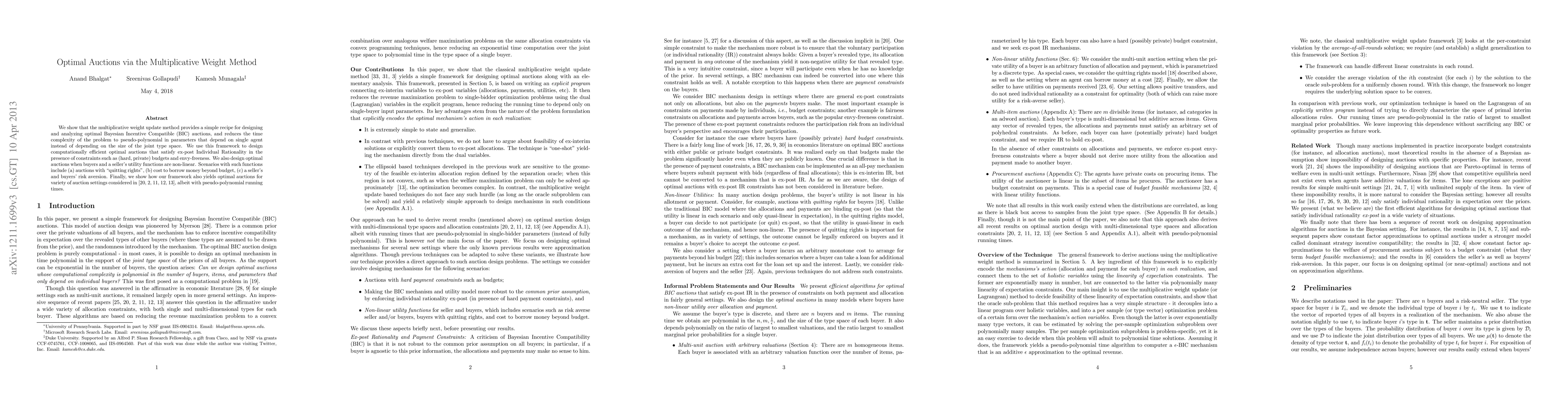

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)