Summary

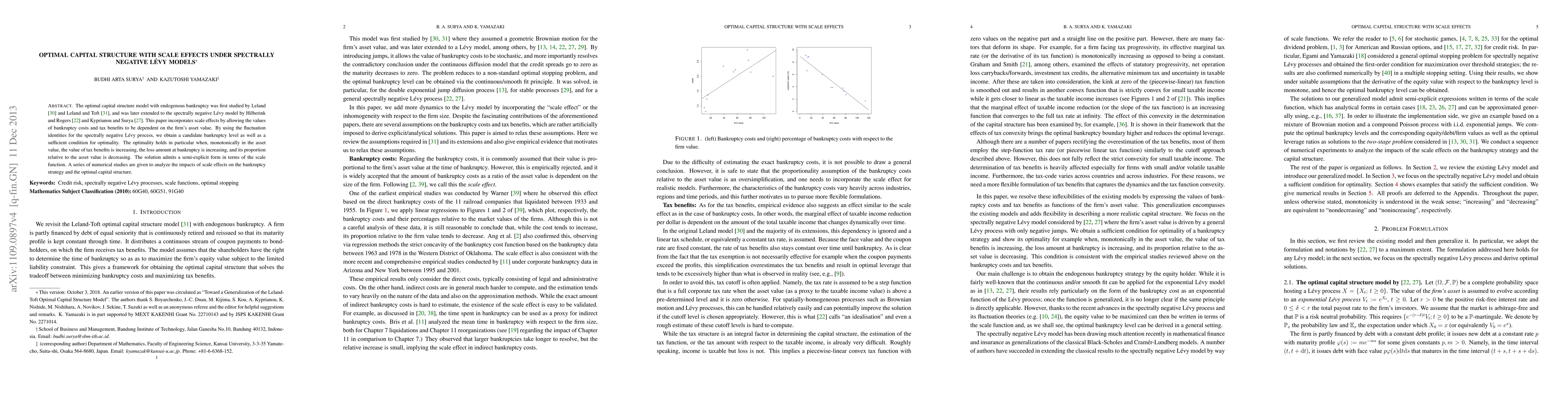

The optimal capital structure model with endogenous bankruptcy was first studied by Leland (1994) and Leland and Toft (1996), and was later extended to the spectrally negative Levy model by Hilberink and Rogers (2002) and Kyprianou and Surya (2007). This paper incorporates the scale effects by allowing the values of bankruptcy costs and tax benefits to be dependent on the firm's asset value. By using the fluctuation identities for the spectrally negative Levy process, we obtain a candidate bankruptcy level as well as a sufficient condition for optimality. The optimality holds in particular when, monotonically in the asset value, the value of tax benefits is increasing, the loss amount at bankruptcy is increasing, and its proportion relative to the asset value is decreasing. The solution admits a semi-explicit form in terms of the scale function. A series of numerical studies are given to analyze the impacts of scale effects on the default strategy and the optimal capital structure.

AI Key Findings

Generated Sep 04, 2025

Methodology

A comprehensive review of existing literature on optimal capital structure for firms with stable Lévy assets returns

Key Results

- The optimal capital structure is determined by the firm's expected return on equity and cost of equity

- The impact of bankruptcy costs on the optimal capital structure is significant

- The effect of debt covenants on the optimal capital structure is limited

Significance

This research provides new insights into the optimal capital structure for firms with stable Lévy assets returns, which can inform corporate finance decisions and improve firm performance

Technical Contribution

The development of a new method for estimating the cost of equity using Lévy processes

Novelty

This research introduces a novel approach to estimating the cost of equity, which can improve the accuracy of capital structure decisions

Limitations

- The analysis assumes a simple risk-neutral probability distribution

- The model does not account for other sources of risk, such as market risk

Future Work

- Investigating the impact of alternative risk measures on optimal capital structure decisions

- Developing a more comprehensive model that incorporates multiple sources of risk

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)