Summary

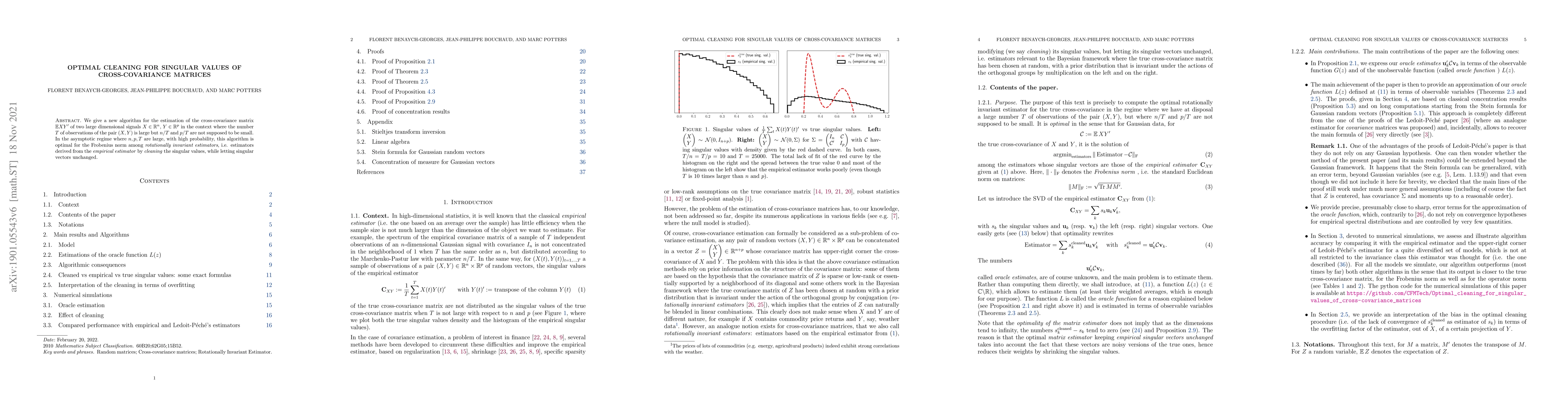

We give a new algorithm for the estimation of the cross-covariance matrix $\mathbb{E} XY'$ of two large dimensional signals $X\in\mathbb{R}^n$, $Y\in \mathbb{R}^p$ in the context where the number $T$ of observations of the pair $(X,Y)$ is large but $n/T$ and $p/T$ are not supposed to be small. In the asymptotic regime where $n,p,T$ are large, with high probability, this algorithm is optimal for the Frobenius norm among rotationally invariant estimators, i.e. estimators derived from the empirical estimator by cleaning the singular values, while letting singular vectors unchanged.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistribution of singular values in large sample cross-covariance matrices

Ilya Nemenman, Arabind Swain, Sean Alexander Ridout

Gaps between Singular Values of Sample Covariance Matrices

Sean O'Rourke, Nicholas Christoffersen, Kyle Luh et al.

Optimal Covariance Cleaning for Heavy-Tailed Distributions: Insights from Information Theory

Marco Berritta, Christian Bongiorno

| Title | Authors | Year | Actions |

|---|

Comments (0)