Summary

We study an optimal consumption and investment problem in a possibly incomplete market with general, not necessarily convex, stochastic constraints. We give explicit solutions for investors with exponential, logarithmic and power utility. Our approach is based on martingale methods which rely on recent results on the existence and uniqueness of solutions to BSDEs with drivers of quadratic growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

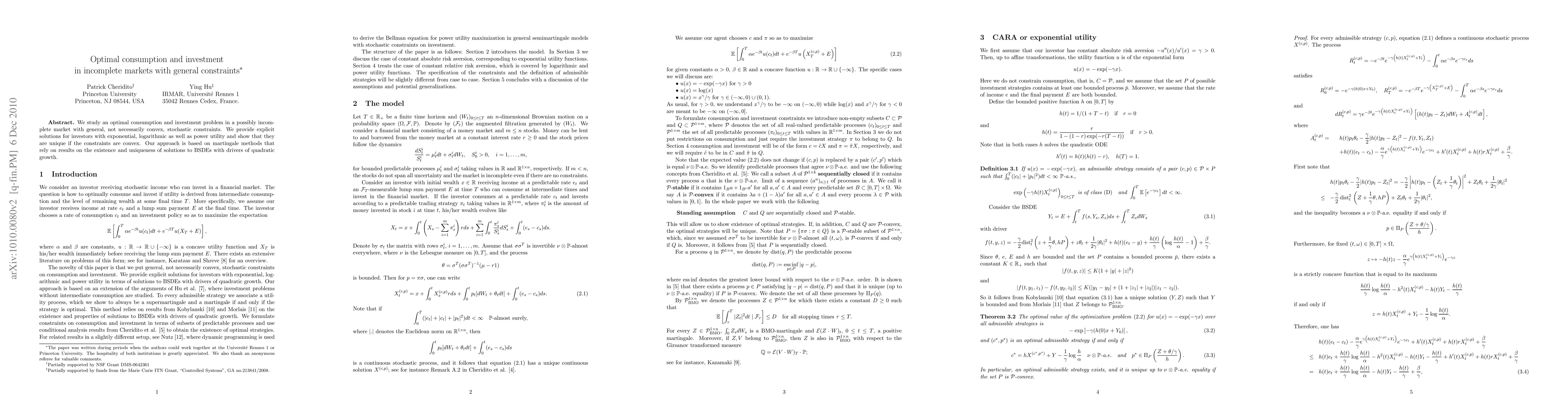

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)