Authors

Summary

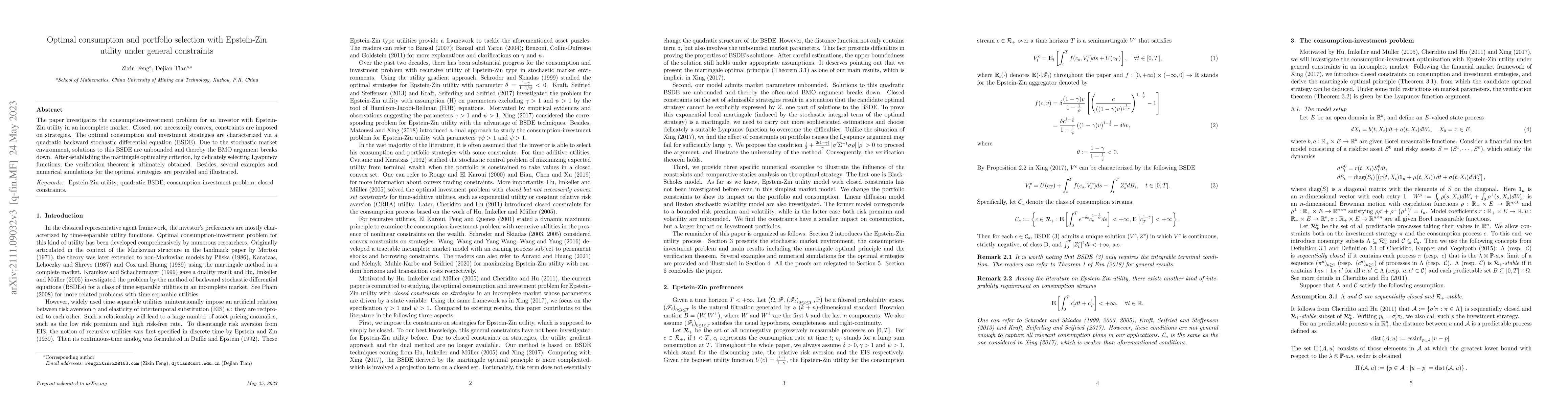

The paper investigates the consumption-investment problem for an investor with Epstein-Zin utility in an incomplete market. Closed, not necessarily convex, constraints are imposed on strategies. The optimal consumption and investment strategies are characterized via a quadratic backward stochastic differential equation (BSDE). Due to the stochastic market environment, the solution to this BSDE is unbounded and thereby the BMO argument breaks down. After establishing the martingale optimality criterion, by delicately selecting Lyapunov functions, the verification theorem is ultimately obtained. Besides, several examples and numerical simulations for the optimal strategies are provided and illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Comfortable Consumption under Epstein-Zin utility

Zimu Zhu, Dejian Tian, Weidong Tian

Mean Field Portfolio Games with Epstein-Zin Preferences

Guanxing Fu, Ulrich Horst

Optimal consumption and investment under relative performance criteria with Epstein-Zin utility

Lorenzo Stanca, Frank Riedel, Jodi Dianetti

No citations found for this paper.

Comments (0)