Summary

In this paper, we study the optimal investment problem of an insurer whose surplus process follows the diffusion approximation of the classical Cramer-Lundberg model. Investment in the foreign market is allowed, and therefore, the foreign exchange rate model is considered and incorporated. It is assumed that the instantaneous mean growth rate of foreign exchange rate price follows an Ornstein-Uhlenbeck process. Dynamic programming method is employed to study the problem of maximizing the expected exponential utility of terminal wealth. By soloving the correspoding Hamilton-Jacobi-Bellman equations, the optimal investment strategies and the value functions are obtained. Finally, numerical analysis is presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

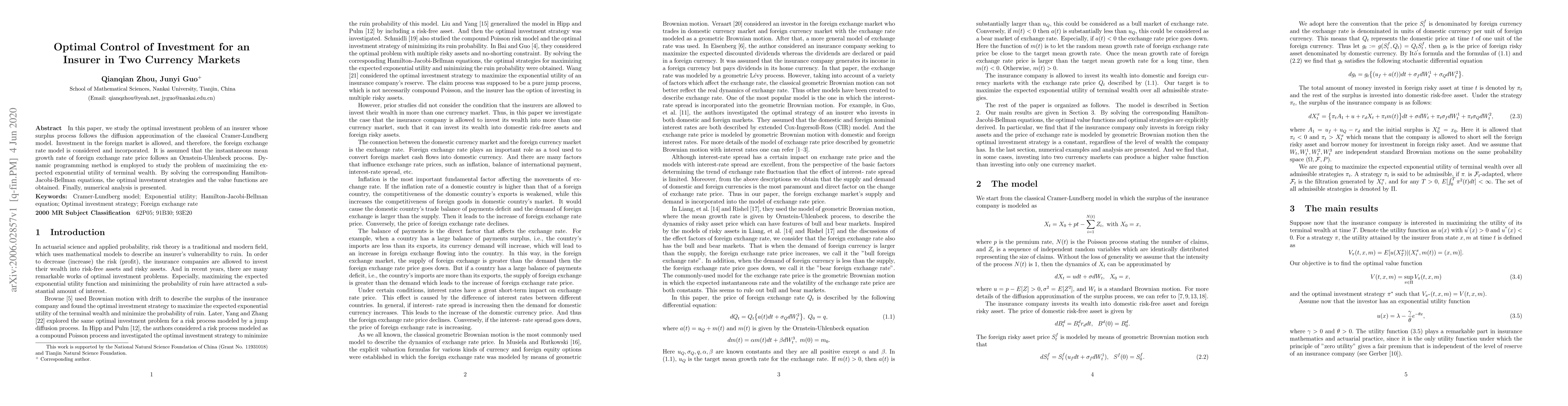

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)