Summary

In this paper we set up an optimal control framework for a hybrid stochastic system with dual or multiple Markov switching diffusion processes, while Markov chains governing these switching diffusions are not identical as assumed by the existing literature. As an application and illustration of this model, we solve a portfolio choice problem for an investor facing financial and labor markets that are both regime switching. In continuous time context we combine two separate Markov chains into one synthetic Markov chain and derive its corresponding generator matrix, then state the HJB equations for the optimal control problem with the newly synthesized Markov switching diffusion. Furthermore, we derive explicit solutions and value functions under some reasonable specifications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

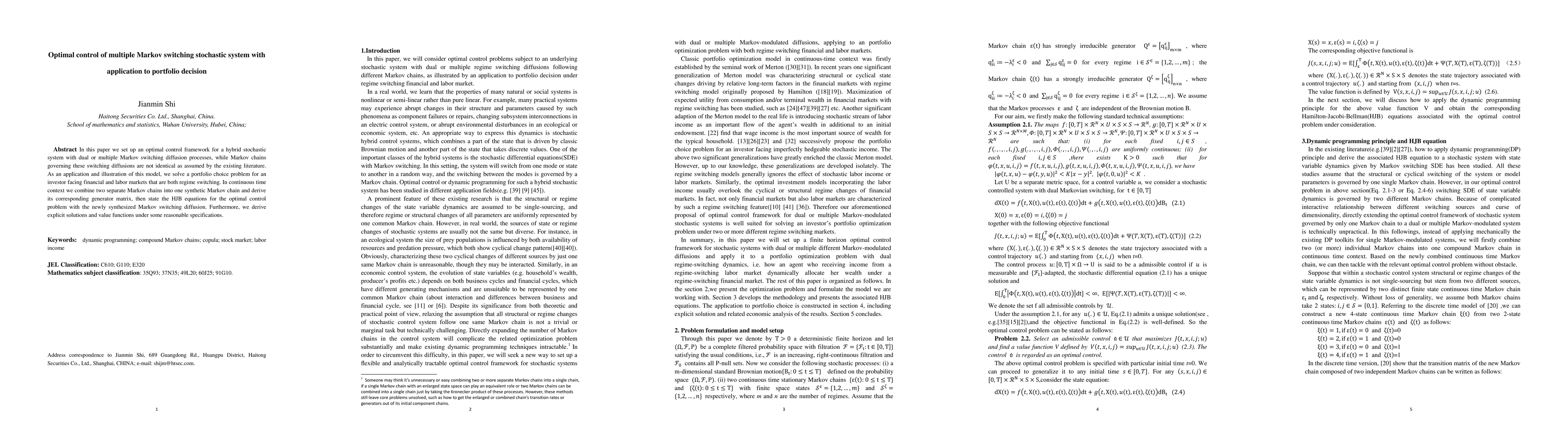

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstrained stochastic LQ control with regime switching and application to portfolio selection

Ying Hu, Xiaomin Shi, Zuo Quan Xu

No citations found for this paper.

Comments (0)