Summary

We study a coupled system of controlled stochastic differential equations (SDEs) driven by a Brownian motion and a compensated Poisson random measure, consisting of a forward SDE in the unknown process $X(t)$ and a \emph{predictive mean-field} backward SDE (BSDE) in the unknowns $Y(t), Z(t), K(t,\cdot)$. The driver of the BSDE at time $t$ may depend not just upon the unknown processes $Y(t), Z(t), K(t,\cdot)$, but also on the predicted future value $Y(t+\delta)$, defined by the conditional expectation $A(t):= E[Y(t+\delta) | \mathcal{F}_t]$. \\ We give a sufficient and a necessary maximum principle for the optimal control of such systems, and then we apply these results to the following two problems:\\ (i) Optimal portfolio in a financial market with an \emph{insider influenced asset price process.} \\ (ii) Optimal consumption rate from a cash flow modeled as a geometric It\^ o-L\' evy SDE, with respect to \emph{predictive recursive utility}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

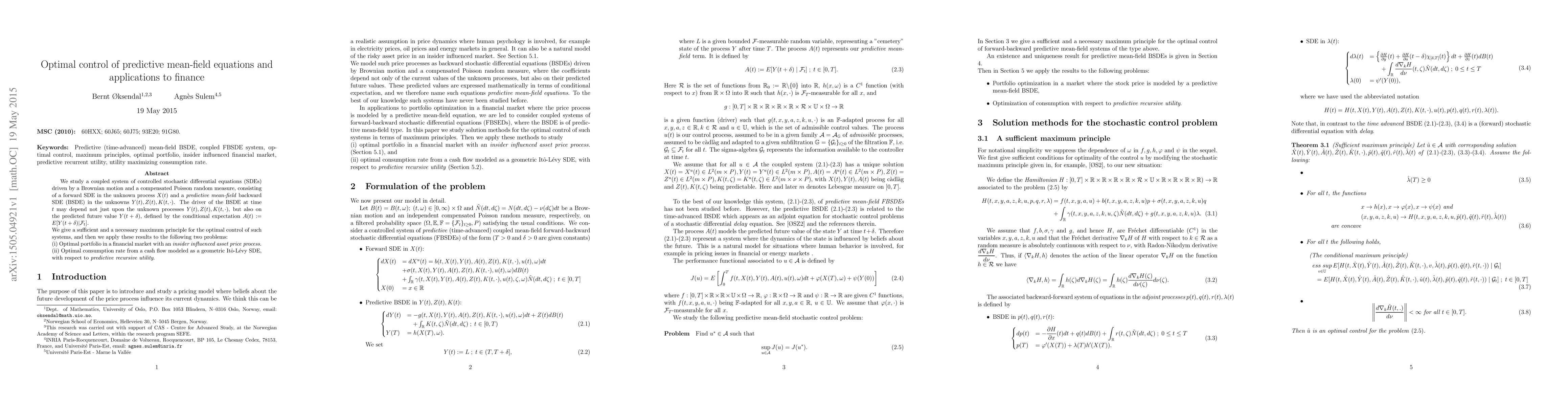

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)