Summary

In this manuscript we consider a class optimal control problem for stochastic differential delay equations. First, we rewrite the problem in a suitable infinite-dimensional Hilbert space. Then, using the dynamic programming approach, we characterize the value function of the problem as the unique viscosity solution of the associated infinite-dimensional Hamilton-Jacobi-Bellman equation. Finally, we prove a $C^{1,\alpha}$-partial regularity of the value function. We apply these results to path dependent financial and economic problems (Merton-like portfolio problem and optimal advertising).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

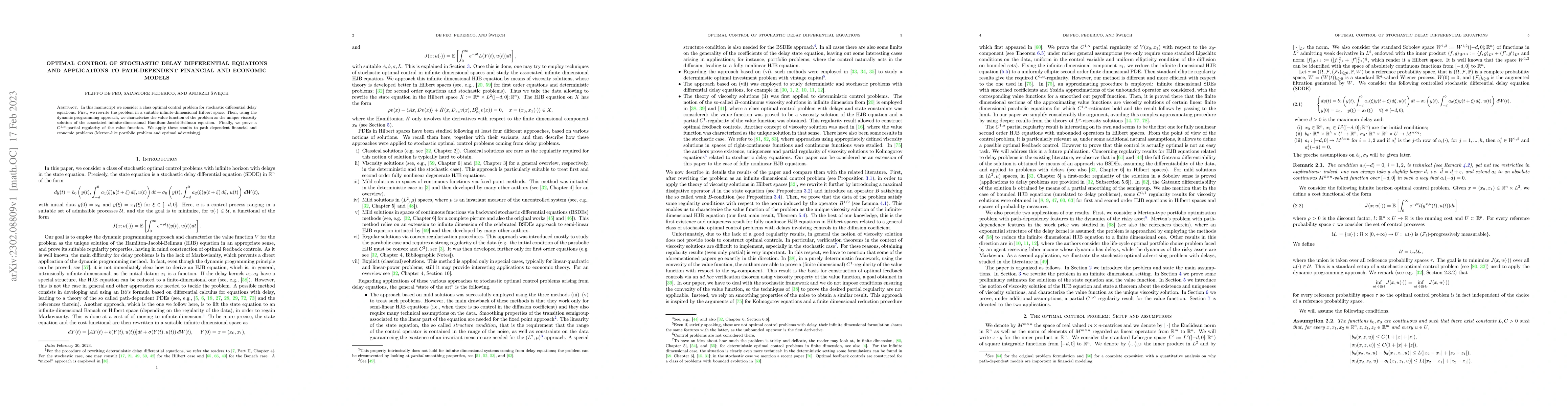

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal control of stochastic delay differential equations: Optimal feedback controls

Filippo de Feo, Andrzej Święch

| Title | Authors | Year | Actions |

|---|

Comments (0)