Summary

The literature on continuous-time stochastic optimal control seldom deals with the case of discrete state spaces. In this paper, we provide a general framework for the optimal control of continuous-time Markov chains on finite graphs. In particular, we provide results on the long-term behavior of value functions and optimal controls, along with results on the associated ergodic Hamilton-Jacobi equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

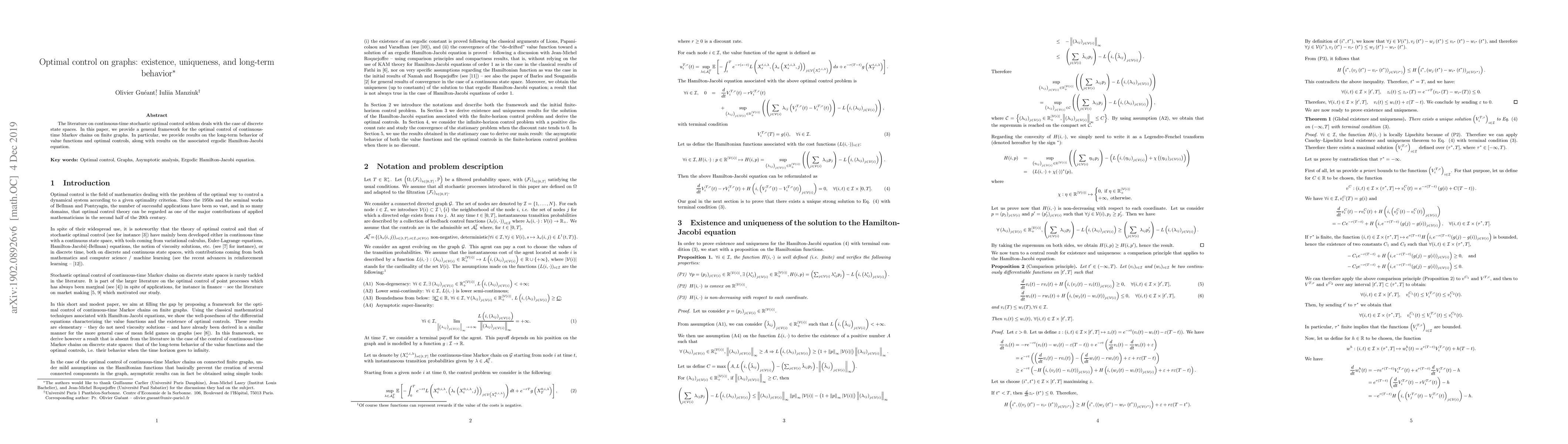

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExistence, uniqueness, and long-time behavior of linearized field dislocation dynamics

Amit Acharya, Marshall Slemrod

| Title | Authors | Year | Actions |

|---|

Comments (0)