Summary

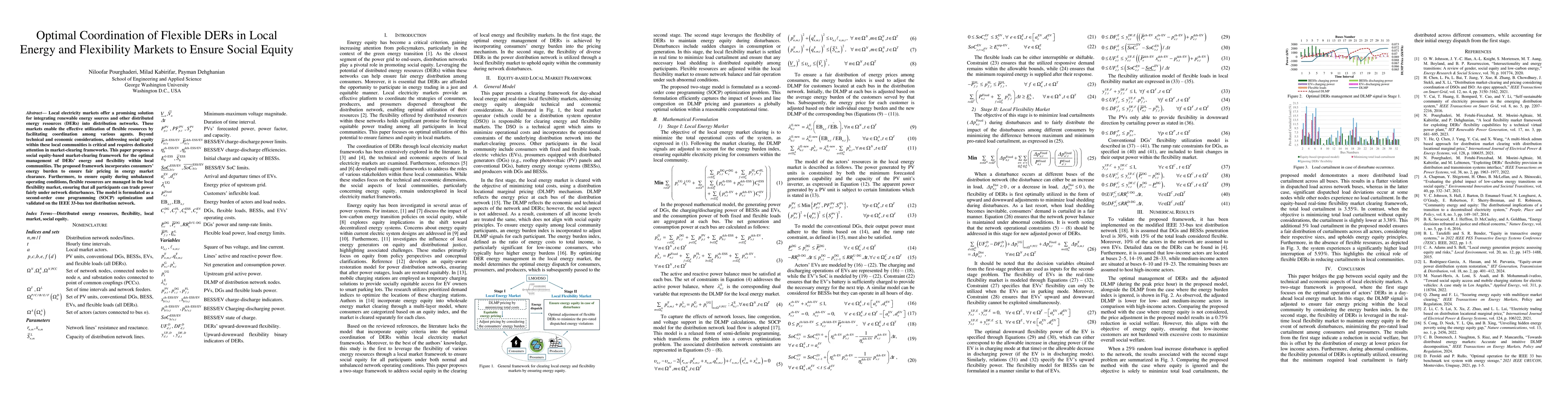

Local electricity markets offer a promising solution for integrating renewable energy sources and other distributed energy resources (DERs) into distribution networks. These markets enable the effective utilization of flexible resources by facilitating coordination among various agents. Beyond technical and economic considerations, addressing social equity within these local communities is critical and requires dedicated attention in market-clearing frameworks. This paper proposes a social equity-based market-clearing framework for the optimal management of DERs' energy and flexibility within local communities. The proposed framework incorporates consumers' energy burden to ensure fair pricing in energy market clearance. Furthermore, to ensure equity during unbalanced operating conditions, flexible resources are managed in the local flexibility market, ensuring that all participants can trade power fairly under network disturbances. The model is formulated as a second-order cone programming (SOCP) optimization and validated on the IEEE 33-bus test distribution network.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper proposes a social equity-based market-clearing framework for optimal DER management, formulated as a second-order cone programming (SOCP) optimization problem and validated on the IEEE 33-bus test distribution network.

Key Results

- A market-clearing framework that incorporates consumers' energy burden for fair pricing in energy market clearance.

- Flexible resources managed in the local flexibility market to ensure fair power trading during network disturbances.

- Validation of the proposed method on the IEEE 33-bus test distribution network.

Significance

This research is important for integrating renewable energy sources and DERs into distribution networks while addressing social equity concerns, ensuring fair pricing and resource allocation in local communities.

Technical Contribution

The development of a social equity-based market-clearing framework for DERs, formulated as a SOCP optimization problem.

Novelty

This work differs from existing research by explicitly addressing social equity concerns within local energy markets, ensuring fair pricing and resource allocation for consumers.

Limitations

- The proposed method was validated on a single test distribution network (IEEE 33-bus).

- The impact of larger, more complex networks on the framework's performance is not explicitly addressed.

Future Work

- Explore the applicability and performance of the proposed framework in larger, more complex distribution networks.

- Investigate the integration of additional social equity factors and their impact on market outcomes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic Flexibility Aggregation of DERs for Ancillary Services Provision

Mario Paolone, Matthieu Jacobs

Combinatorial Auctions and Graph Neural Networks for Local Energy Flexibility Markets

Yan Zhang, Awadelrahman M. A. Ahmed, Frank Eliassen

No citations found for this paper.

Comments (0)