Summary

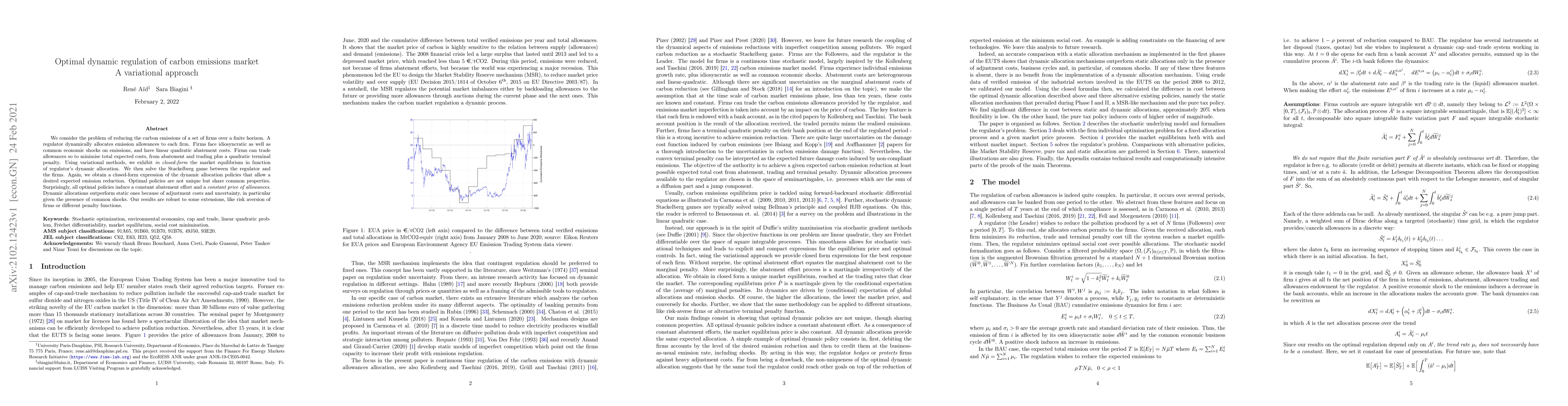

We consider the problem of reducing the carbon emissions of a set of firms over a finite horizon. A regulator dynamically allocates emission allowances to each firm. Firms face idiosyncratic as well as common economic shocks on emissions, and have linear quadratic abatement costs. Firms can trade allowances so to minimise total expected costs, from abatement and trading plus a quadratic terminal penalty. Using variational methods, we exhibit in closed-form the market equilibrium in function of regulator's dynamic allocation. We then solve the Stackelberg game between the regulator and the firms. Again, we obtain a closed-form expression of the dynamic allocation policies that allow a desired expected emission reduction. Optimal policies are not unique but share common properties. Surprisingly, all optimal policies induce a constant abatement effort and a constant price of allowances. Dynamic allocations outperform static ones because of adjustment costs and uncertainty, in particular given the presence of common shocks. Our results are robust to some extensions, like risk aversion of firms or different penalty functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTracing two decades of carbon emissions using a network approach

Tiziano Squartini, Rossana Mastrandrea, Gianluca Guidi et al.

Towards Carbon Transparency: A High-Resolution Carbon Emissions Database for China's Listed Companies

Yuheng Cheng, Guolong Liu, Wenxuan Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)