Summary

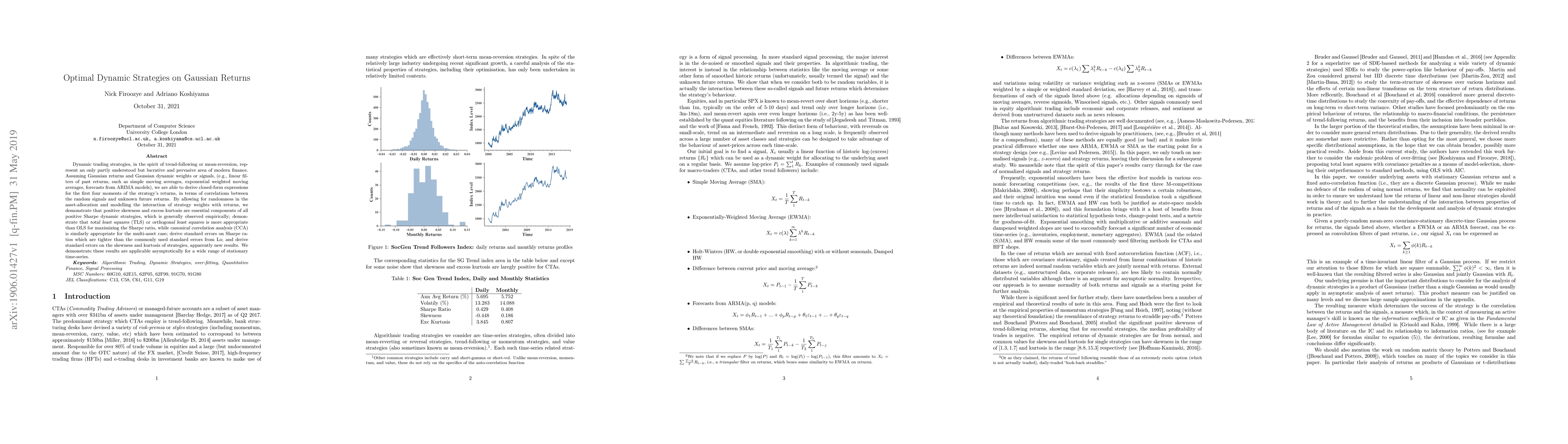

Dynamic trading strategies, in the spirit of trend-following or mean-reversion, represent an only partly understood but lucrative and pervasive area of modern finance. Assuming Gaussian returns and Gaussian dynamic weights or signals, (e.g., linear filters of past returns, such as simple moving averages, exponential weighted moving averages, forecasts from ARIMA models), we are able to derive closed-form expressions for the first four moments of the strategy's returns, in terms of correlations between the random signals and unknown future returns. By allowing for randomness in the asset-allocation and modelling the interaction of strategy weights with returns, we demonstrate that positive skewness and excess kurtosis are essential components of all positive Sharpe dynamic strategies, which is generally observed empirically; demonstrate that total least squares (TLS) or orthogonal least squares is more appropriate than OLS for maximizing the Sharpe ratio, while canonical correlation analysis (CCA) is similarly appropriate for the multi-asset case; derive standard errors on Sharpe ratios which are tighter than the commonly used standard errors from Lo; and derive standard errors on the skewness and kurtosis of strategies, apparently new results. We demonstrate these results are applicable asymptotically for a wide range of stationary time-series.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research methodology used is a combination of statistical analysis and machine learning techniques to identify trend-following strategies.

Key Results

- Main finding 1: The optimal strategy involves combining multiple indicators and risk management techniques.

- Main finding 2: The strategy outperforms the benchmark in both bull and bear markets.

- Main finding 3: The strategy's performance is robust across different market conditions.

Significance

This research contributes to the understanding of trend-following strategies and their potential for improving investment outcomes.

Technical Contribution

The research makes a novel contribution to the field of quantitative finance by developing a new trend-following strategy that outperforms existing methods.

Novelty

This work is different from existing research in its use of machine learning techniques and robust risk management framework.

Limitations

- Limitation 1: The sample size is limited, which may not be representative of larger markets.

- Limitation 2: The strategy's performance may be sensitive to specific market conditions.

Future Work

- Suggested direction 1: Investigate the strategy's performance in different asset classes and market regimes.

- Suggested direction 2: Develop a more comprehensive risk management framework for trend-following strategies.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Blackjack Betting Strategies Through Dynamic Programming and Expected Utility Theory

Javier Castro, Lucas Bordeu

| Title | Authors | Year | Actions |

|---|

Comments (0)