Summary

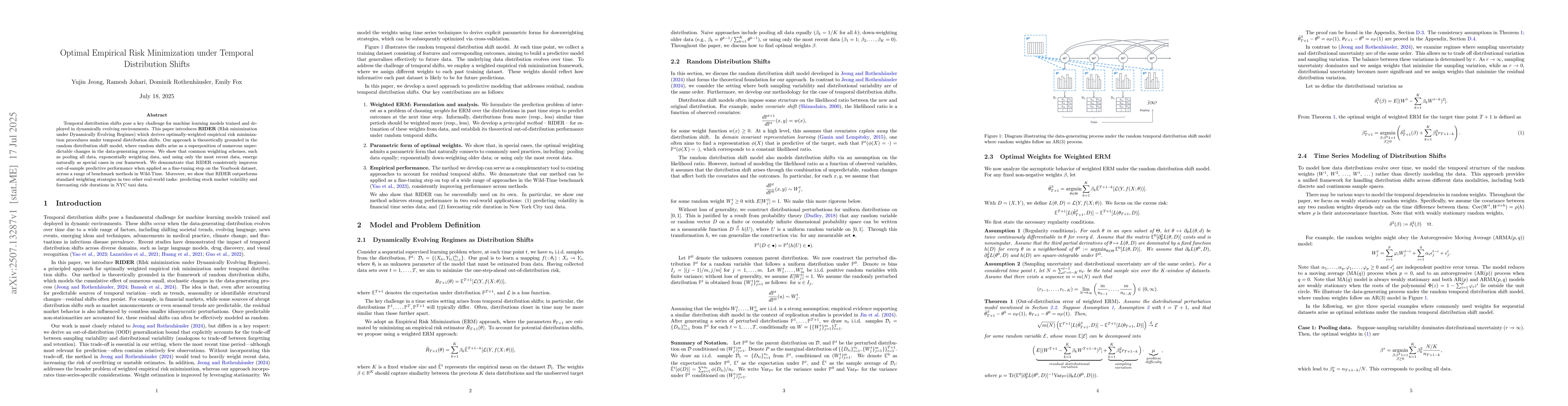

Temporal distribution shifts pose a key challenge for machine learning models trained and deployed in dynamically evolving environments. This paper introduces RIDER (RIsk minimization under Dynamically Evolving Regimes) which derives optimally-weighted empirical risk minimization procedures under temporal distribution shifts. Our approach is theoretically grounded in the random distribution shift model, where random shifts arise as a superposition of numerous unpredictable changes in the data-generating process. We show that common weighting schemes, such as pooling all data, exponentially weighting data, and using only the most recent data, emerge naturally as special cases in our framework. We demonstrate that RIDER consistently improves out-of-sample predictive performance when applied as a fine-tuning step on the Yearbook dataset, across a range of benchmark methods in Wild-Time. Moreover, we show that RIDER outperforms standard weighting strategies in two other real-world tasks: predicting stock market volatility and forecasting ride durations in NYC taxi data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonotonic Risk Relationships under Distribution Shifts for Regularized Risk Minimization

Reinhard Heckel, Jiayu Liu, Daniel LeJeune

Optimal Excess Risk Bounds for Empirical Risk Minimization on $p$-Norm Linear Regression

Ayoub El Hanchi, Murat A. Erdogdu

No citations found for this paper.

Comments (0)