Summary

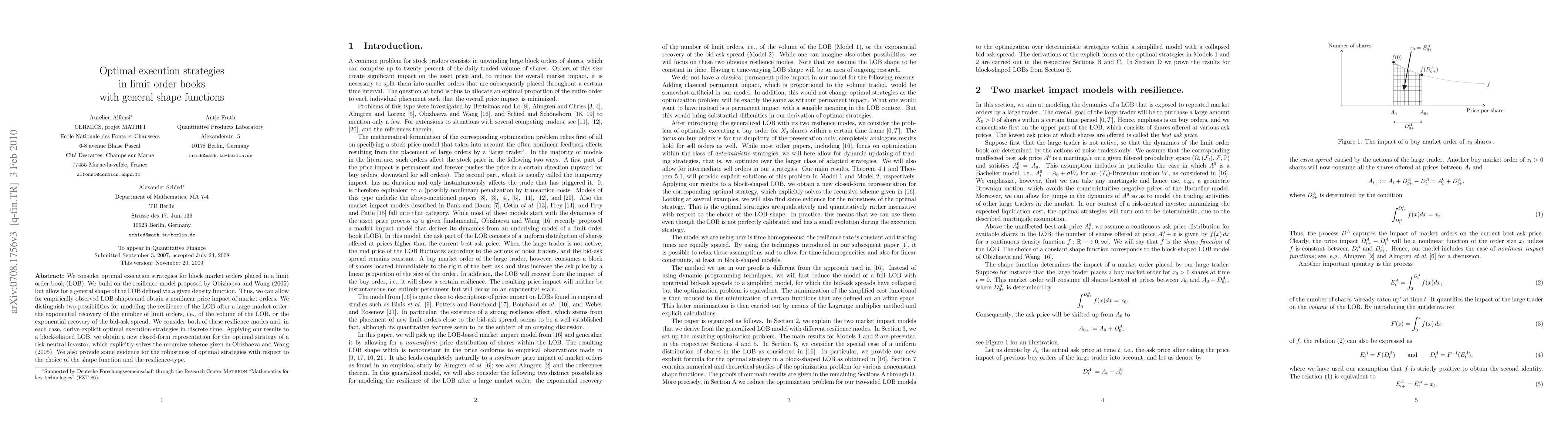

We consider optimal execution strategies for block market orders placed in a limit order book (LOB). We build on the resilience model proposed by Obizhaeva and Wang (2005) but allow for a general shape of the LOB defined via a given density function. Thus, we can allow for empirically observed LOB shapes and obtain a nonlinear price impact of market orders. We distinguish two possibilities for modeling the resilience of the LOB after a large market order: the exponential recovery of the number of limit orders, i.e., of the volume of the LOB, or the exponential recovery of the bid-ask spread. We consider both of these resilience modes and, in each case, derive explicit optimal execution strategies in discrete time. Applying our results to a block-shaped LOB, we obtain a new closed-form representation for the optimal strategy, which explicitly solves the recursive scheme given in Obizhaeva and Wang (2005). We also provide some evidence for the robustness of optimal strategies with respect to the choice of the shape function and the resilience-type.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)