Authors

Summary

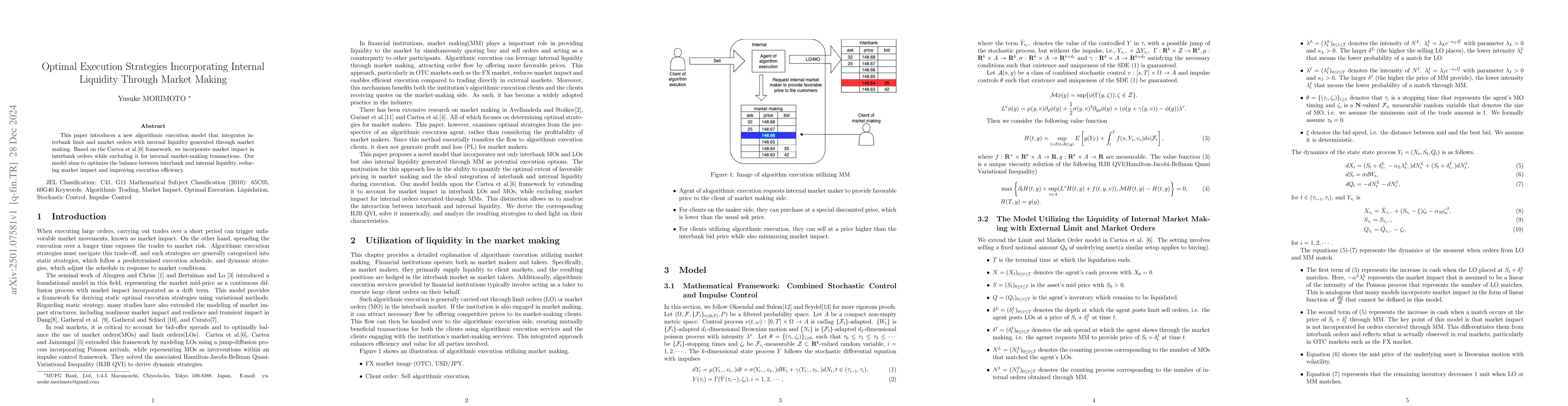

This paper introduces a new algorithmic execution model that integrates interbank limit and market orders with internal liquidity generated through market making. Based on the Cartea et al.\cite{cartea2015algorithmic} framework, we incorporate market impact in interbank orders while excluding it for internal market-making transactions. Our model aims to optimize the balance between interbank and internal liquidity, reducing market impact and improving execution efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal Execution under Liquidity Uncertainty

Sergio Pulido, Etienne Chevalier, Yadh Hafsi et al.

Decentralised Finance and Automated Market Making: Execution and Speculation

Álvaro Cartea, Fayçal Drissi, Marcello Monga

No citations found for this paper.

Comments (0)