Summary

We study a n-player and mean-field portfolio optimization problem under relative performance concerns with non-zero volatility, for wealth and consumption. The consistency assumption defining forward relative performance processes leads to a sufficient characterization of such processes with mean of a Stochastic HJB equations, which highlights the link between wealth and consumption utility, and also characterizes the optimal strategies. In particular, forward relative performance processes with a wealth utility of CRRA type and separable time and space dependence necessarily have a consumption utility of the same form, with the same risk aversion parameter. This characterization gives a better understanding of the drift condition ensuring time consistency. In this setting, we establish closed form of the Nash equilibrium for both the n-player and mean eld problems. We also provide some numerical examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

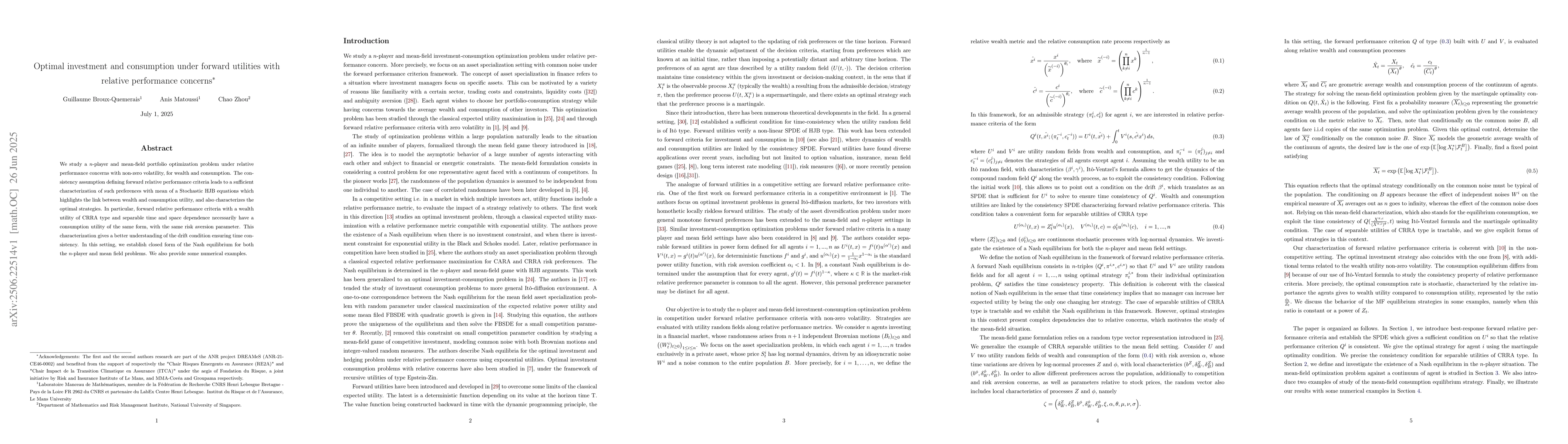

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal investment and consumption with forward preferences and uncertain parameters

Gechun Liang, Wing Fung Chong

Forward utility and market adjustments in relative investment-consumption games of many players

Goncalo dos Reis, Vadim Platonov

No citations found for this paper.

Comments (0)