Summary

In this paper, we investigate dynamic optimization problems featuring both stochastic control and optimal stopping in a finite time horizon. The paper aims to develop new methodologies, which are significantly different from those of mixed dynamic optimal control and stopping problems in the existing literature, to study a manager's decision. We formulate our model to a free boundary problem of a fully nonlinear equation. Furthermore, by means of a dual transformation for the above problem, we convert the above problem to a new free boundary problem of a linear equation. Finally, we apply the theoretical results to challenging, yet practically relevant and important, risk-sensitive problems in wealth management to obtain the properties of the optimal strategy and the right time to achieve a certain level over a finite time investment horizon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

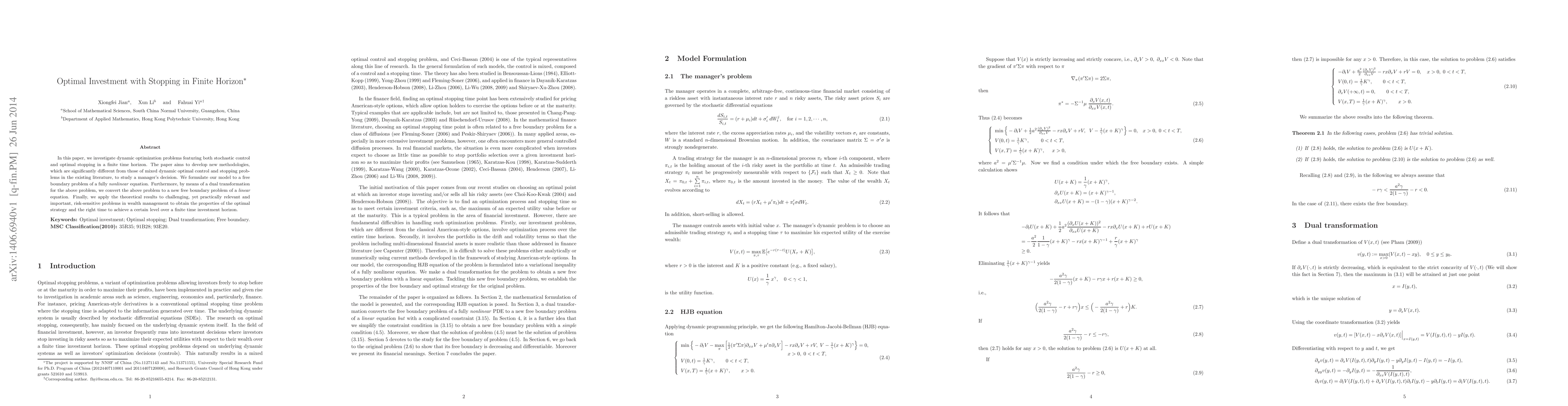

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)