Authors

Summary

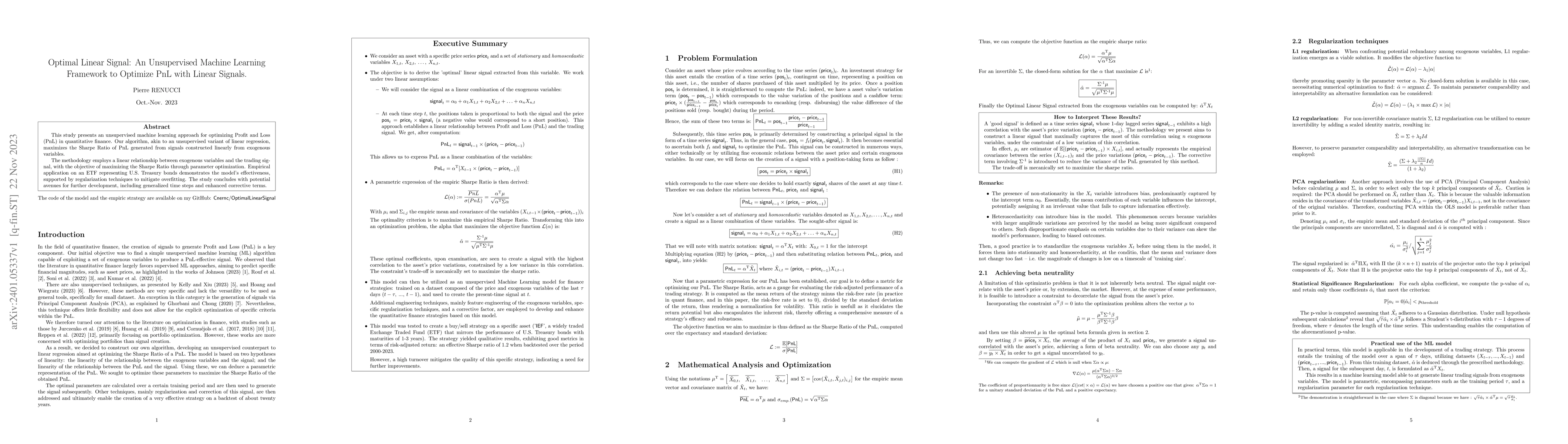

This study presents an unsupervised machine learning approach for optimizing Profit and Loss (PnL) in quantitative finance. Our algorithm, akin to an unsupervised variant of linear regression, maximizes the Sharpe Ratio of PnL generated from signals constructed linearly from exogenous variables. The methodology employs a linear relationship between exogenous variables and the trading signal, with the objective of maximizing the Sharpe Ratio through parameter optimization. Empirical application on an ETF representing U.S. Treasury bonds demonstrates the model's effectiveness, supported by regularization techniques to mitigate overfitting. The study concludes with potential avenues for further development, including generalized time steps and enhanced corrective terms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning to Optimize for Mixed-Integer Non-linear Programming

Bo Tang, Ján Drgoňa, Elias B. Khalil

Integer linear programming for unsupervised training set selection in molecular machine learning

Friedrich Eisenbrand, Clemence Corminboeuf, Jan Weinreich et al.

No citations found for this paper.

Comments (0)