Summary

Following the recent literature on make take fees policies, we consider an exchange wishing to set a suitable contract with several market makers in order to improve trading quality on its platform. To do so, we use a principal-agent approach, where the agents (the market makers) optimise their quotes in a Nash equilibrium fashion, providing best response to the contract proposed by the principal (the exchange). This contract aims at attracting liquidity on the platform. This is because the wealth of the exchange depends on the arrival of market orders, which is driven by the spread of market makers. We compute the optimal contract in quasi explicit form and also derive the optimal spread policies for the market makers. Several new phenomena appears in this multi market maker setting. In particular we show that it is not necessarily optimal to have a large number of market makers in the presence of a contracting scheme.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

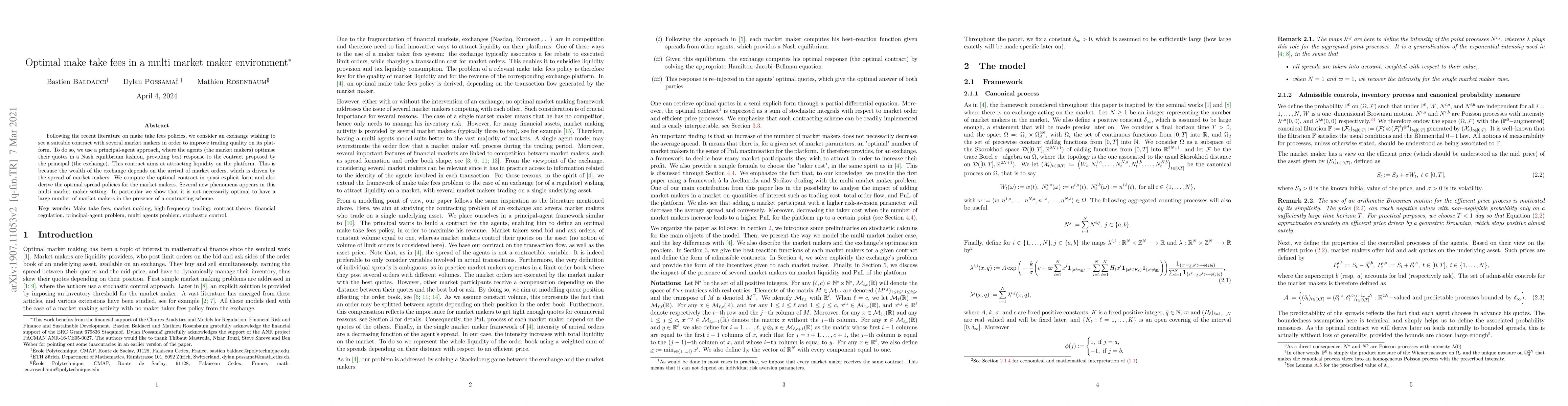

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Dynamic Fees in Automated Market Makers

Leandro Sánchez-Betancourt, Martin Herdegen, Leonardo Baggiani

| Title | Authors | Year | Actions |

|---|

Comments (0)