Summary

One of the most celebrated results in mechanism design is Myerson's characterization of the revenue optimal auction for selling a single item. However, this result relies heavily on the assumption that buyers are indifferent to risk. In this paper we investigate the case where the buyers are risk-loving, i.e. they prefer gambling to being rewarded deterministically. We use the standard model for risk from expected utility theory, where risk-loving behavior is represented by a convex utility function. We focus our attention on the special case of exponential utility functions. We characterize the optimal auction and show that randomization can be used to extract more revenue than when buyers are risk-neutral. Most importantly, we show that the optimal auction is simple: the optimal revenue can be extracted using a randomized take-it-or-leave-it price for a single buyer and using a loser-pay auction, a variant of the all-pay auction, for multiple buyers. Finally, we show that these results no longer hold for convex utility functions beyond exponential.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

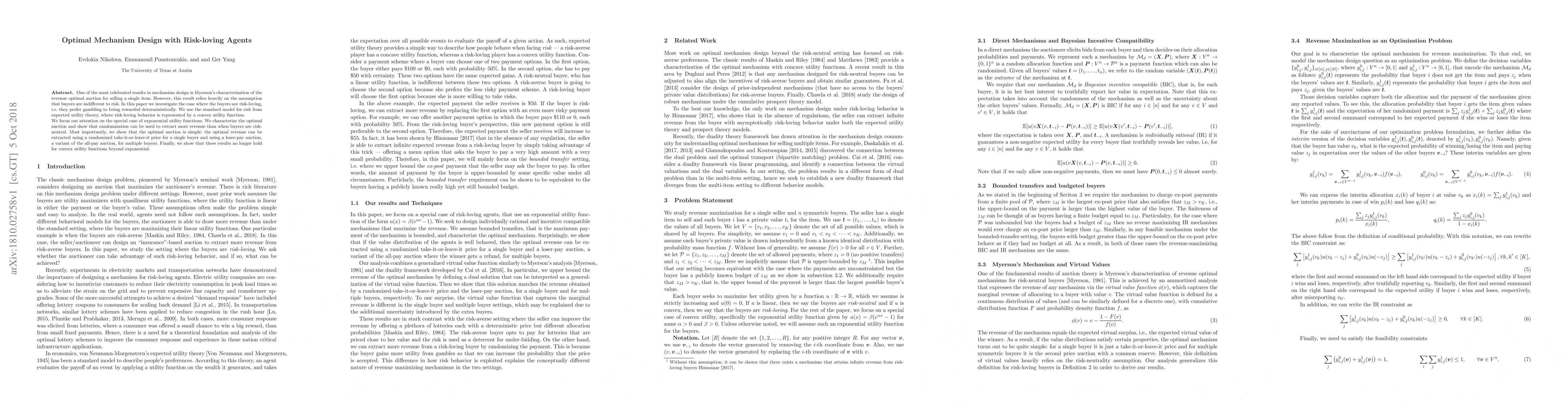

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)