Summary

This paper studies the problem of the deterministic version of the Verification Theorem for the optimal m-states switching in infinite horizon under Markovian framework with arbitrary switching cost functions. The problem is formulated as an extended impulse control problem and solved by means of probabilistic tools such as the Snell envelop of processes and reflected backward stochastic differential equations. A viscosity solutions approach is employed to carry out a finne analysis on the associated system of m variational inequalities with inter-connected obstacles. We show that the vector of value functions of the optimal problem is the unique viscosity solution to the system. This problem is in relation with the valuation of firms in a financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

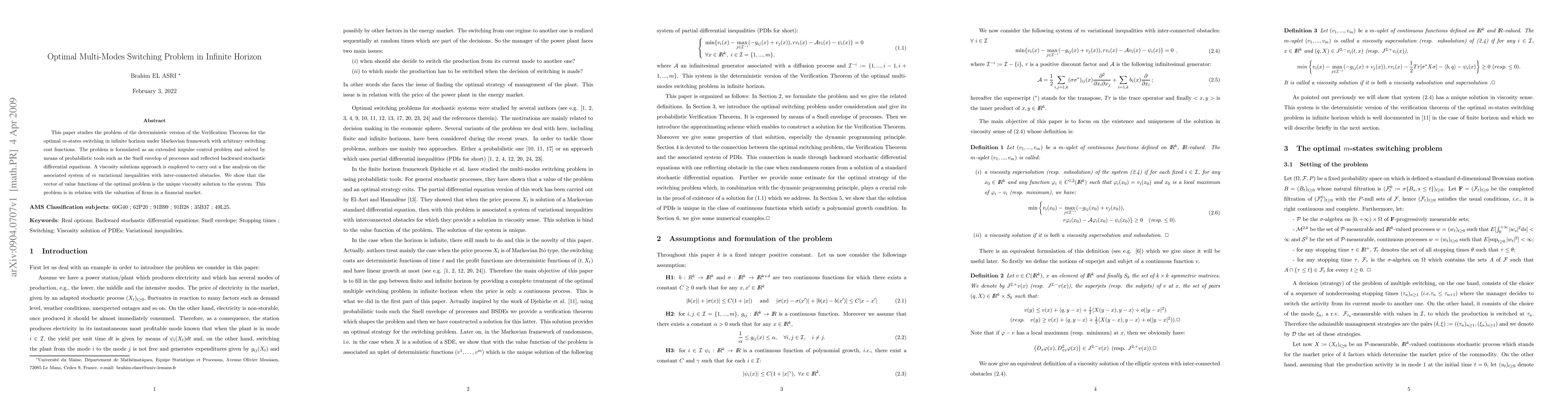

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)