Summary

In the multi-unit pricing problem, multiple units of a single item are for sale. A buyer's valuation for $n$ units of the item is $v \min \{ n, d\} $, where the per unit valuation $v$ and the capacity $d$ are private information of the buyer. We consider this problem in the Bayesian setting, where the pair $(v,d)$ is drawn jointly from a given probability distribution. In the \emph{unlimited supply} setting, the optimal (revenue maximizing) mechanism is a pricing problem, i.e., it is a menu of lotteries. In this paper we show that under a natural regularity condition on the probability distributions, which we call \emph{decreasing marginal revenue}, the optimal pricing is in fact \emph{deterministic}. It is a price curve, offering $i$ units of the item for a price of $p_i$, for every integer $i$. Further, we show that the revenue as a function of the prices $p_i$ is a \emph{concave} function, which implies that the optimum price curve can be found in polynomial time. This gives a rare example of a natural multi-parameter setting where we can show such a clean characterization of the optimal mechanism. We also give a more detailed characterization of the optimal prices for the case where there are only two possible demands.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

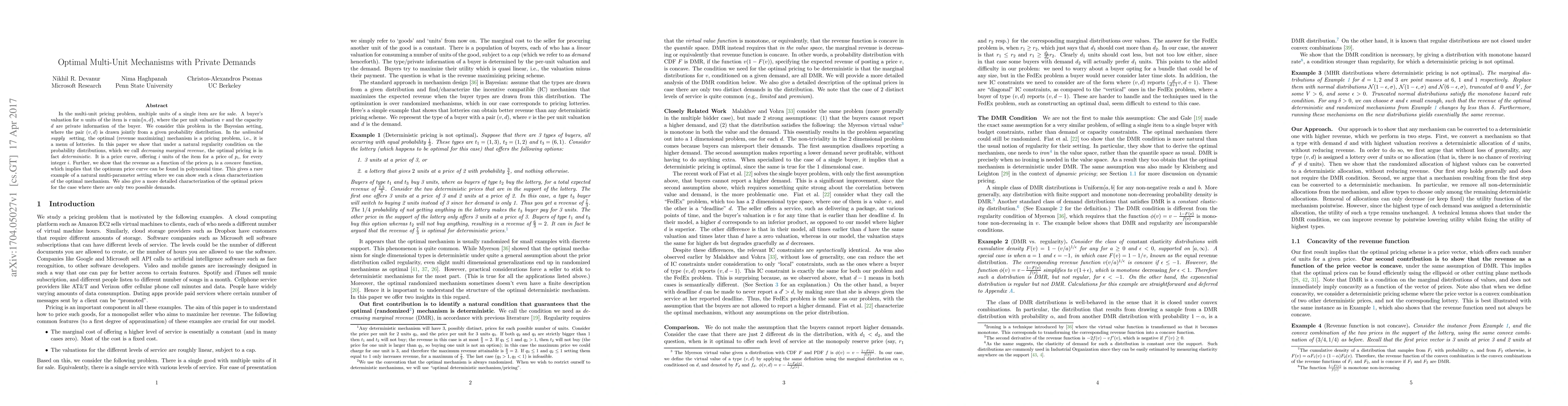

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCoded Caching with Private Demands and Caches

Mingyue Ji, Giuseppe Caire, Ali Gholami et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)