Summary

We consider the holder of an individual tontine retirement account, with maximum and minimum withdrawal amounts (per year) specified. The tontine account holder initiates the account at age 65, and earns mortality credits while alive, but forfeits all wealth in the account upon death. The holder desires to maximize total withdrawals, and minimize the expected shortfall, assuming the holder survives to age 95. The investor controls the amount withdrawn each year and the fraction of the investments in stocks and bonds. The optimal controls are determined based on a parametric model fitted to almost a century of market data. The optimal control algorithm is based on dynamic programming and solution of a partial integro differential equation (PIDE) using Fourier methods. The optimal strategy (based on the parametric model) is tested out of sample using stationary block bootstrap resampling of the historical data. In terms of an expected total withdrawal, expected shortfall (EW-ES) efficient frontier, the tontine overlay greatly outperforms an optimal strategy (without the tontine overlay), which in turn outperforms a constant weight strategy with withdrawals based on the ubiquitous four per cent rule.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

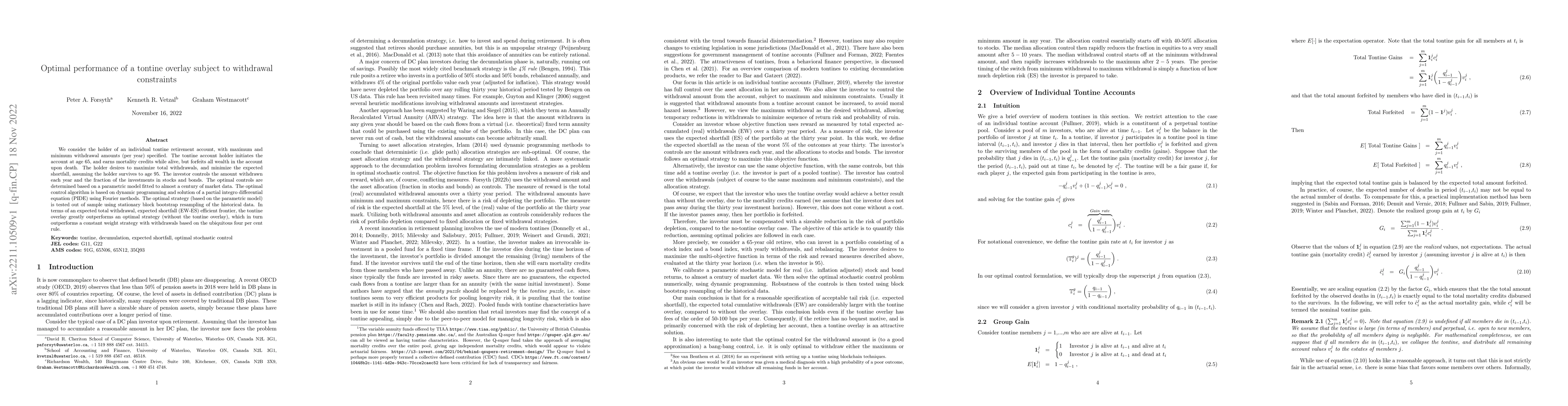

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Riccati Tontine: How to Satisfy Regulators on Average

Moshe A. Milevsky, Thomas S. Salisbury

| Title | Authors | Year | Actions |

|---|

Comments (0)