Authors

Summary

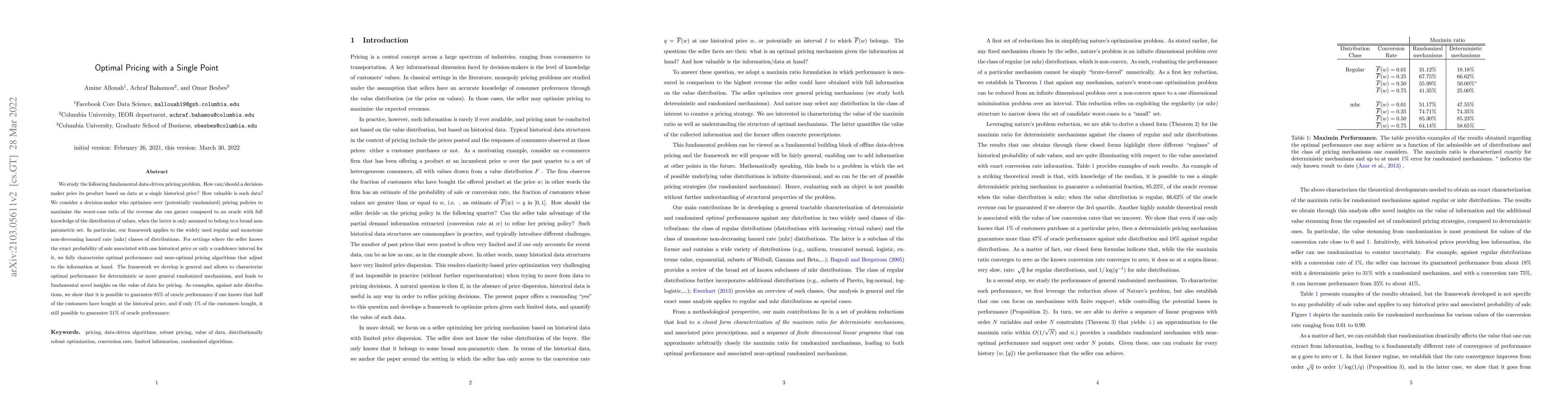

We study the following fundamental data-driven pricing problem. How can/should a decision-maker price its product based on data at a single historical price? How valuable is such data? We consider a decision-maker who optimizes over (potentially randomized) pricing policies to maximize the worst-case ratio of the revenue she can garner compared to an oracle with full knowledge of the distribution of values, when the latter is only assumed to belong to a broad non-parametric set. In particular, our framework applies to the widely used regular and monotone non-decreasing hazard rate (mhr) classes of distributions. For settings where the seller knows the exact probability of sale associated with one historical price or only a confidence interval for it, we fully characterize optimal performance and near-optimal pricing algorithms that adjust to the information at hand. The framework we develop is general and allows to characterize optimal performance for deterministic or more general randomized mechanisms, and leads to fundamental novel insights on the value of data for pricing. As examples, against mhr distributions, we show that it is possible to guarantee $85\%$ of oracle performance if one knows that half of the customers have bought at the historical price, and if only $1\%$ of the customers bought, it still possible to guarantee $51\%$ of oracle performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Pricing With Impatient Customers

Hayriye Ayhan, Jieqi Di, Sigrún Andradóttir

| Title | Authors | Year | Actions |

|---|

Comments (0)