Summary

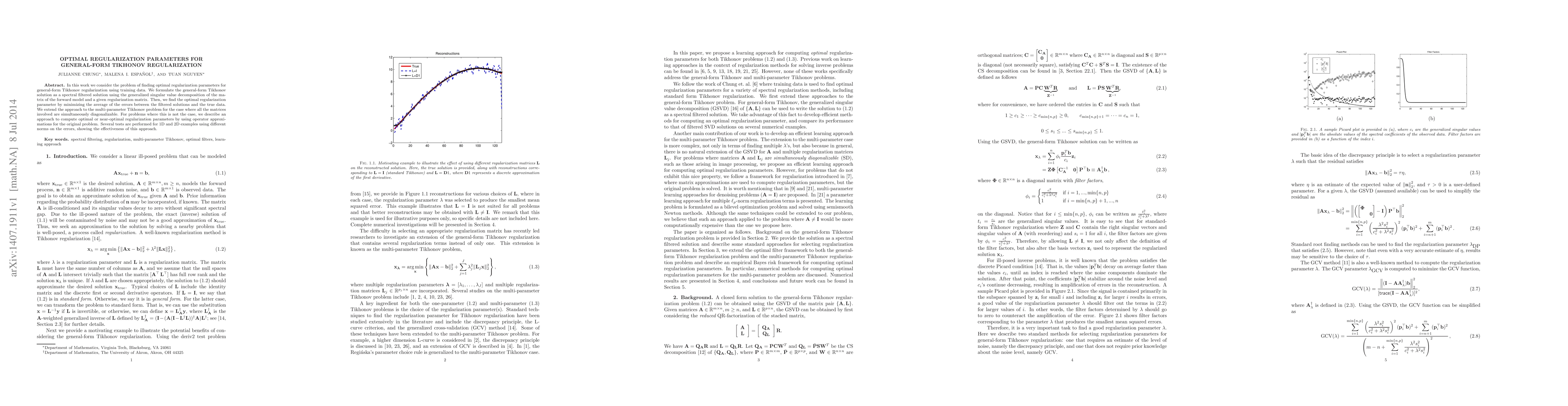

In this work we consider the problem of finding optimal regularization parameters for general-form Tikhonov regularization using training data. We formulate the general-form Tikhonov solution as a spectral filtered solution using the generalized singular value decomposition of the matrix of the forward model and a given regularization matrix. Then, we find the optimal regularization parameter by minimizing the average of the errors between the filtered solutions and the true data. We extend the approach to the multi-parameter Tikhonov problem for the case where all the matrices involved are simultaneously diagonalizable. For problems where this is not the case, we describe an approach to compute optimal or near-optimal regularization parameters by using operator approximations for the original problem. Several tests are performed for 1D and 2D examples using different norms on the errors, showing the effectiveness of this approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive cross approximation for Tikhonov regularization in general form

Lothar Reichel, Marc Van Barel, Thomas Mach

| Title | Authors | Year | Actions |

|---|

Comments (0)