Summary

We study the problem of optimal risk policies and dividend strategies for an insurance company operating under the constraint that the timing of shareholder payouts is governed by the arrival times of a Poisson process. Concurrently, risk control is continuously managed through proportional reinsurance. Our analysis confirms the optimality of a periodic-classical barrier strategy for maximizing the expected net present value until the first instance of bankruptcy across all admissible periodic-classical strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

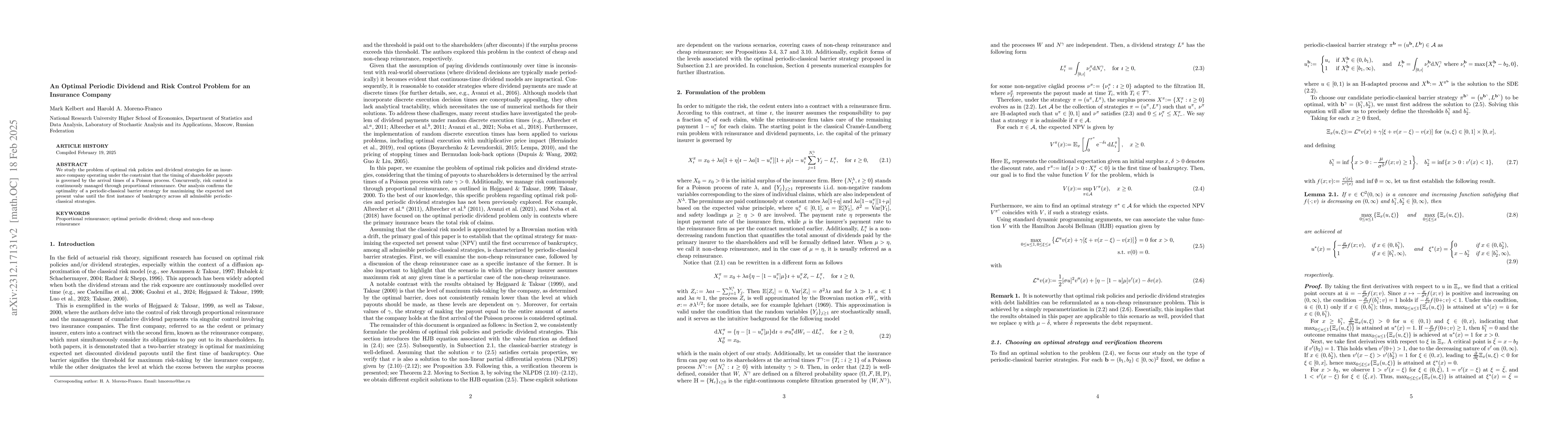

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)