Summary

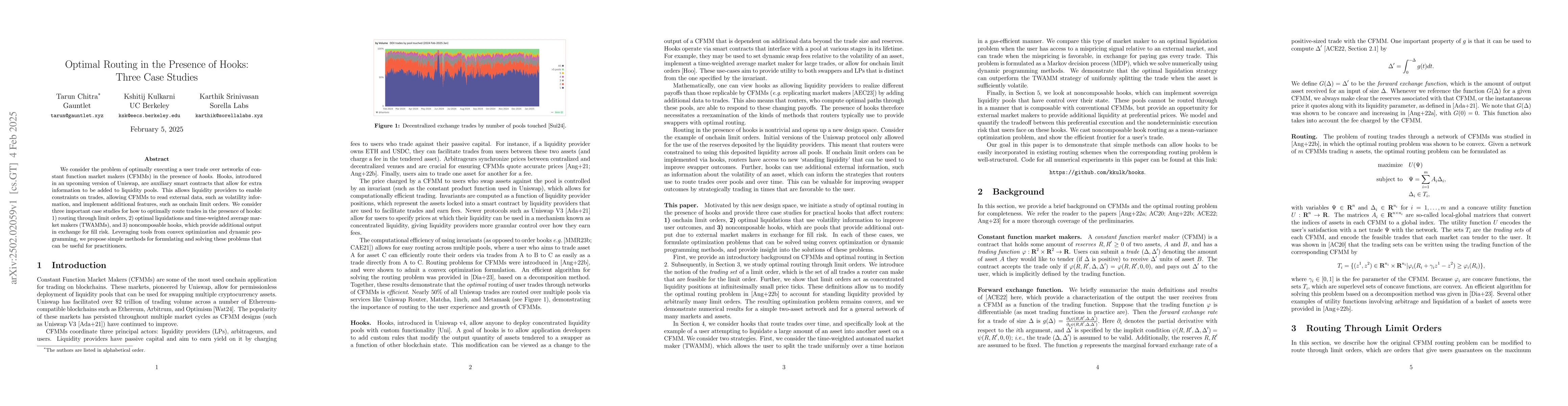

We consider the problem of optimally executing a user trade over networks of constant function market makers (CFMMs) in the presence of hooks. Hooks, introduced in an upcoming version of Uniswap, are auxiliary smart contracts that allow for extra information to be added to liquidity pools. This allows liquidity providers to enable constraints on trades, allowing CFMMs to read external data, such as volatility information, and implement additional features, such as onchain limit orders. We consider three important case studies for how to optimally route trades in the presence of hooks: 1) routing through limit orders, 2) optimal liquidations and time-weighted average market makers (TWAMMs), and 3) noncomposable hooks, which provide additional output in exchange for fill risk. Leveraging tools from convex optimization and dynamic programming, we propose simple methods for formulating and solving these problems that can be useful for practitioners.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper uses tools from convex optimization and dynamic programming to propose methods for formulating and solving optimal routing problems in the presence of hooks in CFMMs.

Key Results

- Proposes methods for optimal routing through limit orders.

- Presents solutions for optimal liquidations and TWAMMs.

Significance

This research is important for practitioners working with CFMMs, as it provides practical methods to optimally execute trades in the presence of hooks, potentially improving efficiency and reducing slippage.

Technical Contribution

The paper introduces a framework for optimally routing trades in CFMMs with hooks, leveraging convex optimization and dynamic programming techniques.

Novelty

This work is novel in its application of optimization tools to the problem of routing trades in the presence of hooks, which are a new feature in CFMMs like Uniswap.

Limitations

- The study focuses on three specific case studies, so results may not generalize to all possible hook configurations or market conditions.

- Assumptions made in the convex optimization and dynamic programming models may not hold in all real-world scenarios.

Future Work

- Explore additional case studies to broaden applicability of proposed methods.

- Investigate the impact of more complex hook configurations on optimal routing strategies.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the distribution of $t$-hooks of doubled distinct partitions

Hyunsoo Cho, Byungchan Kim, Eunmi Kim et al.

The inequality on the number of $1$-hooks, $2$-hooks and $3$-hooks in $t$-regular partitions

Wenston J. T. Zang, Hongshu Lin

On the Number of 2-Hooks and 3-Hooks of Integer Partitions

Eleanor Mcspirit, Kristen Scheckelhoff

No citations found for this paper.

Comments (0)