Summary

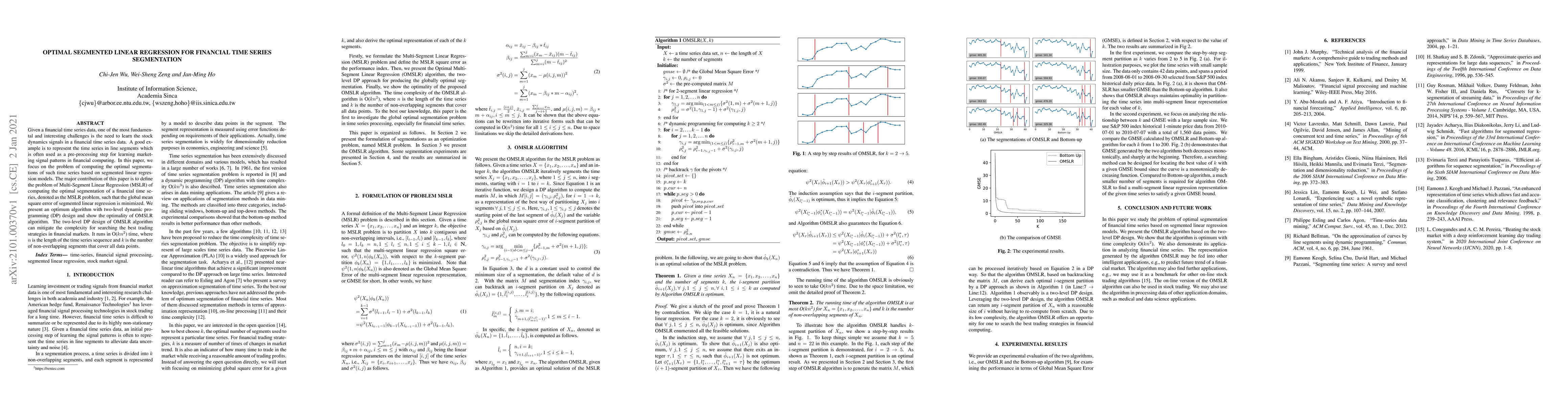

Given a financial time series data, one of the most fundamental and interesting challenges is the need to learn the stock dynamics signals in a financial time series data. A good example is to represent the time series in line segments which is often used as a pre-processing step for learning marketing signal patterns in financial computing. In this paper, we focus on the problem of computing the optimal segmentations of such time series based on segmented linear regression models. The major contribution of this paper is to define the problem of Multi-Segment Linear Regression (MSLR) of computing the optimal segmentation of a financial time series, denoted as the MSLR problem, such that the global mean square error of segmented linear regression is minimized. We present an optimum algorithm with two-level dynamic programming (DP) design and show the optimality of OMSLR algorithm. The two-level DP design of OMSLR algorithm can mitigate the complexity for searching the best trading strategies in financial markets. It runs in O($kn^2$) time, where $n$ is the length of the time series sequence and $k$ is the number of non-overlapping segments that cover all data points.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimultaneous Inference for Time Series Functional Linear Regression

Yan Cui, Zhou Zhou

| Title | Authors | Year | Actions |

|---|

Comments (0)