Summary

We study the Merton problem of optimal consumption-investment for the case of two investors sharing a final wealth. The typical example would be a husband and wife sharing a portfolio looking to optimize the expected utility of consumption and final wealth. Each agent has different utility function and discount factor. An explicit formulation for the optimal consumptions and portfolio can be obtained in the case of a complete market. The problem is shown to be equivalent to maximizing three different utilities separately with separate initial wealths. We study a numerical example where the market price of risk is assumed to be mean reverting, and provide insights on the influence of risk aversion or discount rates on the initial optimal allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

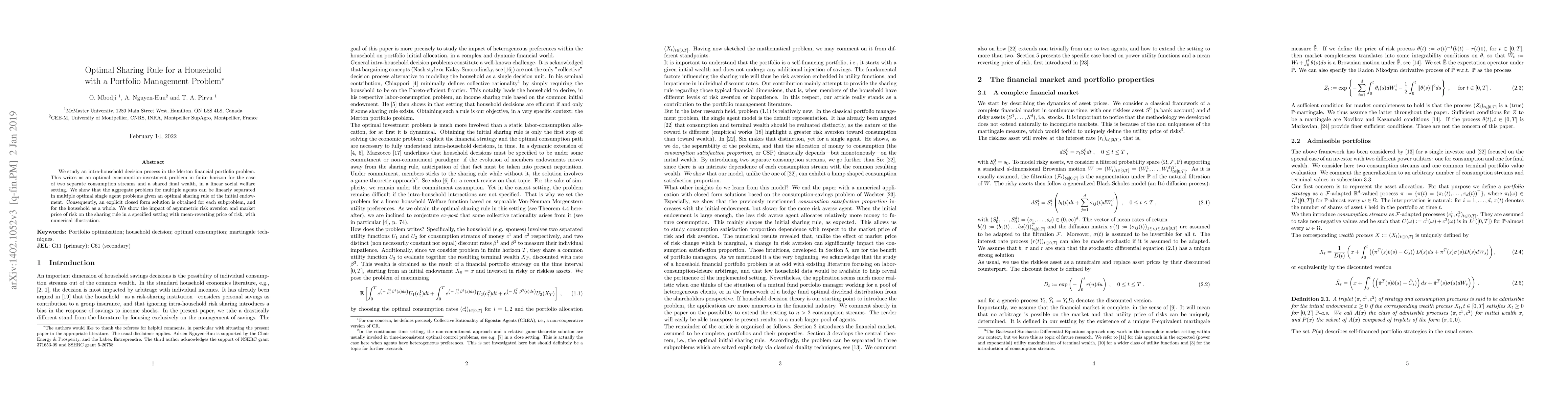

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical applications of the 20/60/20 rule in risk management and portfolio optimization

Marcin Pitera, Kewin Pączek, Damian Jelito et al.

No citations found for this paper.

Comments (0)