Summary

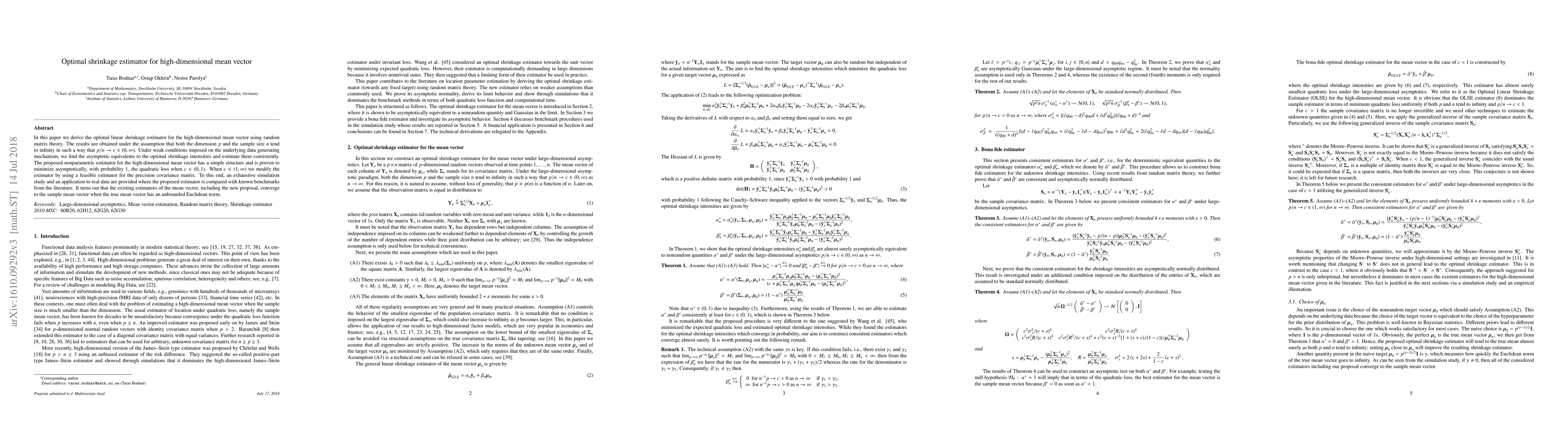

In this paper we derive the optimal linear shrinkage estimator for the high-dimensional mean vector using random matrix theory. The results are obtained under the assumption that both the dimension $p$ and the sample size $n$ tend to infinity in such a way that $p/n \to c\in(0,\infty)$. Under weak conditions imposed on the underlying data generating mechanism, we find the asymptotic equivalents to the optimal shrinkage intensities and estimate them consistently. The proposed nonparametric estimator for the high-dimensional mean vector has a simple structure and is proven to minimize asymptotically, with probability $1$, the quadratic loss when $c\in(0,1)$. When $c\in(1, \infty)$ we modify the estimator by using a feasible estimator for the precision covariance matrix. To this end, an exhaustive simulation study and an application to real data are provided where the proposed estimator is compared with known benchmarks from the literature. It turns out that the existing estimators of the mean vector, including the new proposal, converge to the sample mean vector when the true mean vector has an unbounded Euclidean norm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Linear Shrinkage Estimator for Large Dimensional Precision Matrix

Taras Bodnar, Nestor Parolya, Arjun K. Gupta

Nearly optimal Bayesian Shrinkage for High Dimensional Regression

Faming Liang, Qifan Song

| Title | Authors | Year | Actions |

|---|

Comments (0)