Authors

Summary

This paper considers a pair $(\mathbb{F},\tau)$, where $\mathbb{F}$ is a filtration representing the "public" flow of information which is available to all agents overtime, and $\tau$ is a random time which might not be an $\mathbb{F}$-stopping time. This setting covers the case of credit risk framework where $\tau$ models the default time of a firm or client, and the setting of life insurance where $\tau$ is the death time of an agent. It is clear that random times can not be observed before their occurrence. Thus the larger filtration $\mathbb{G}$, which incorporates $\mathbb{F}$ and makes $\tau$ observable, results from the progressive enlargement of $\mathbb{F}$ with $\tau$. For this informational setting, governed by $\mathbb{G}$, we analyze the optimal stopping problem in three main directions. The first direction consists of characterizing the existence of the solution to this problem in terms of $\mathbb{F}$-observable processes. The second direction lies in deriving the {\it mathematical structures} of the value process of this control problem, while the third direction singles out the associated optimal stopping problem under $\mathbb{F}$. These three aspects allow us to quantify deeply how $\tau$ impact the optimal stopping problem, while they are also vital for studying reflected backward stochastic differential equations which arise {\it naturally} from pricing and hedging of vulnerable claims.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

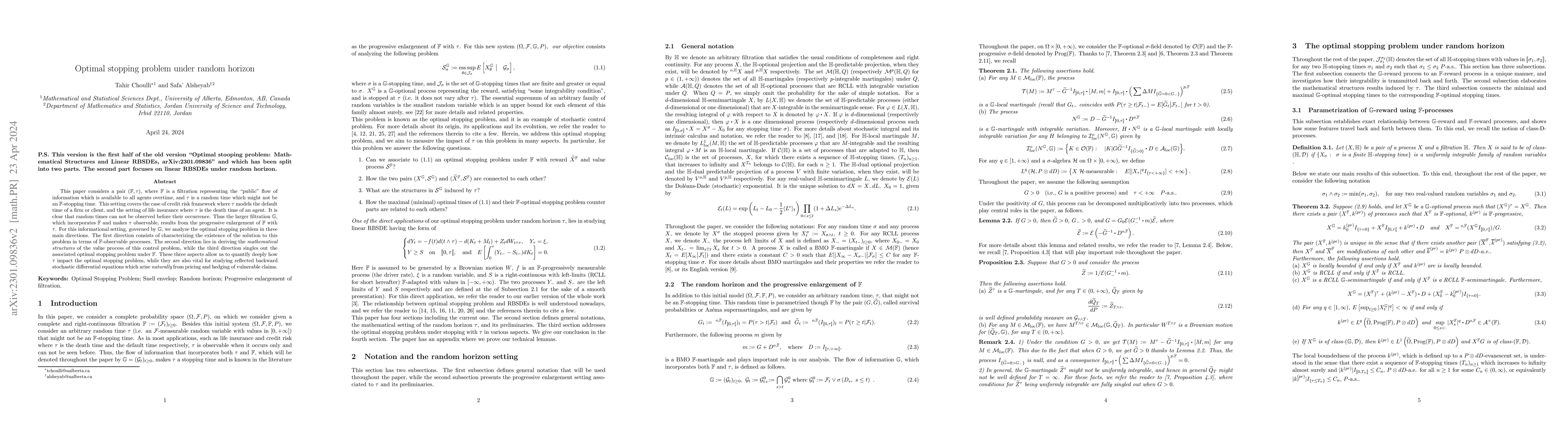

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)