Summary

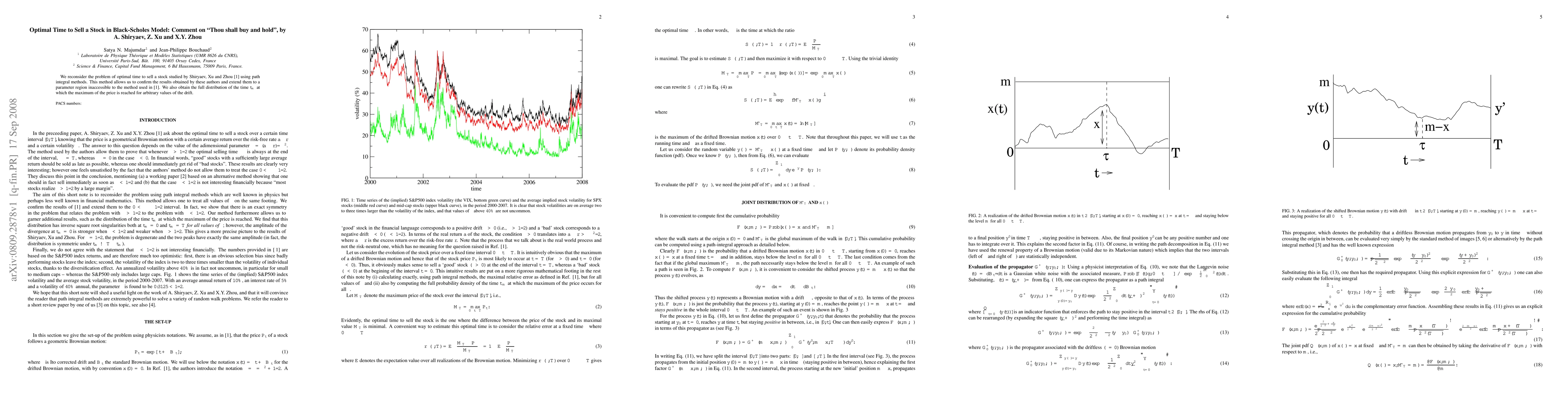

We reconsider the problem of optimal time to sell a stock studied recently by Shiryaev, Xu and Zhou using path integral methods. This method allows us to confirm the results obtained by these authors and extend them to a parameter region inaccessible to the method used by Shiryaev et. al. We also obtain the full distribution of the time t_m at which the maximum of the price is reached for arbitrary values of the drift.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)