Summary

We consider the optimal trade execution strategies for a large portfolio of single stocks proposed by Almgren (2003). This framework accounts for a nonlinear impact of trades on average market prices. The results of Almgren (2003) are based on the assumption that no shares of assets per unit of time are trade at the beginning of the period. We propose a general solution method that accomodates the case of a positive stock of assets in the initial period. Our findings are twofold. First of all, we show that the problem admits a solution with no trading in the opening period only if additional parametric restrictions are imposed. Second, with positive asset holdings in the initial period, the optimal execution time depends on trading activity at the beginning of the planning period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

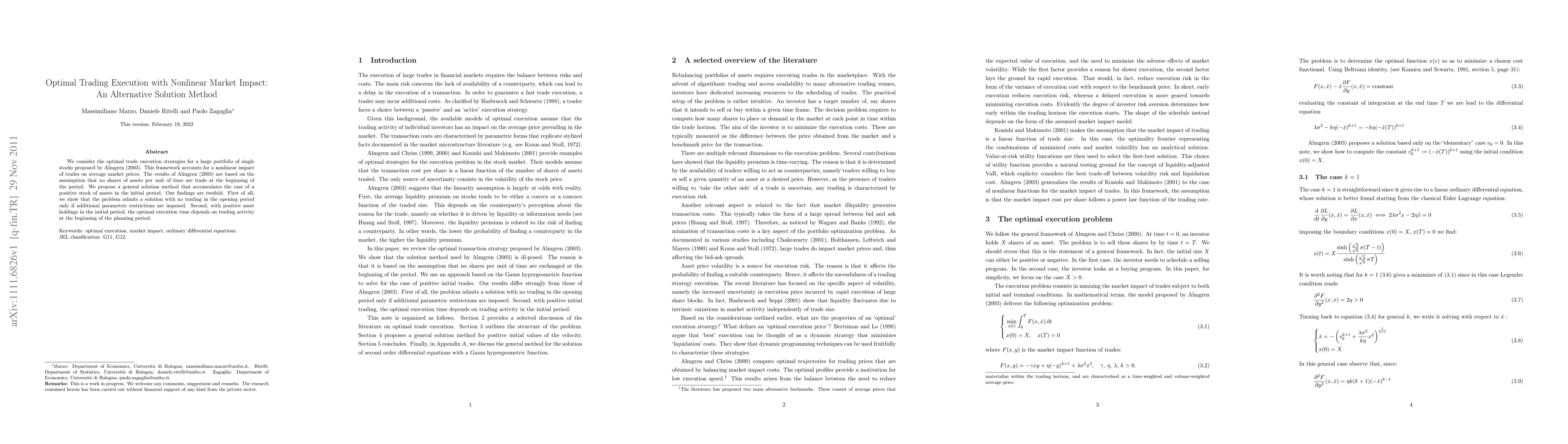

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)