Summary

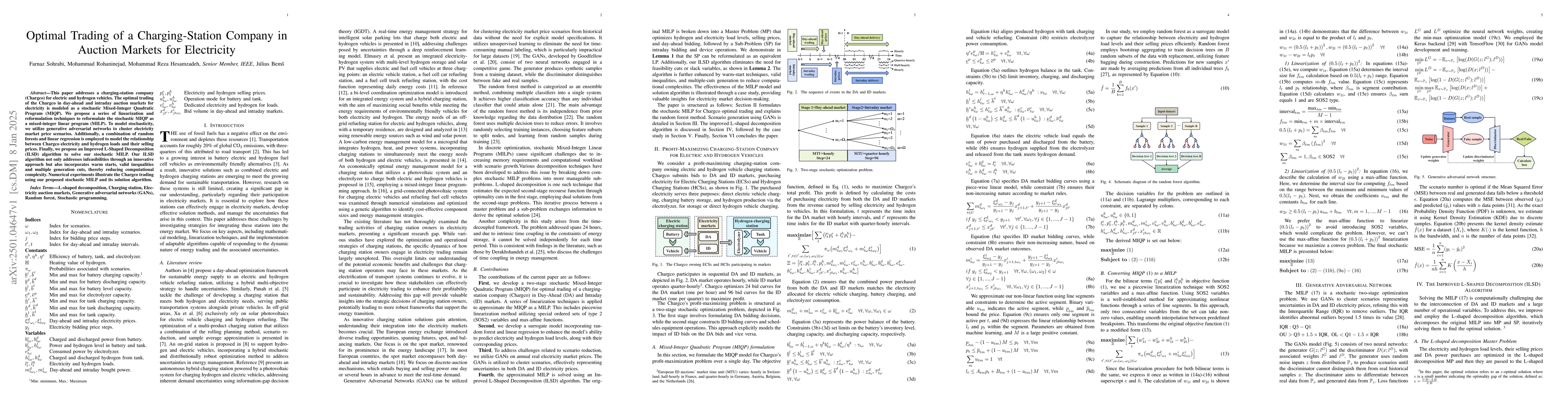

This paper addresses a charging-station company (Chargco) for electric and hydrogen vehicles. The optimal trading of the Chargco in day-ahead and intraday auction markets for electricity is modeled as a stochastic Mixed-Integer Quadratic Program (MIQP). We propose a series of linearization and reformulation techniques to reformulate the stochastic MIQP as a mixed-integer linear program (MILP). To model stochasticity, we utilize generative adversarial networks to cluster electricity market price scenarios. Additionally, a combination of random forests and linear regression is employed to model the relationship between Chargco electricity and hydrogen loads and their selling prices. Finally, we propose an Improved L-Shaped Decomposition (ILSD) algorithm to solve our stochastic MILP. Our ILSD algorithm not only addresses infeasibilities through an innovative approach but also incorporates warm starts, valid inequalities and multiple generation cuts, thereby reducing computational complexity. Numerical experiments illustrate the Chargco trading using our proposed stochastic MILP and its solution algorithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElectrification of Transportation: A Hybrid Benders/SDDP Algorithm for Optimal Charging Station Trading

Zdeněk Hanzálek, Mohammad Rohaninejad, Farnaz Sohrabi et al.

No citations found for this paper.

Comments (0)