Summary

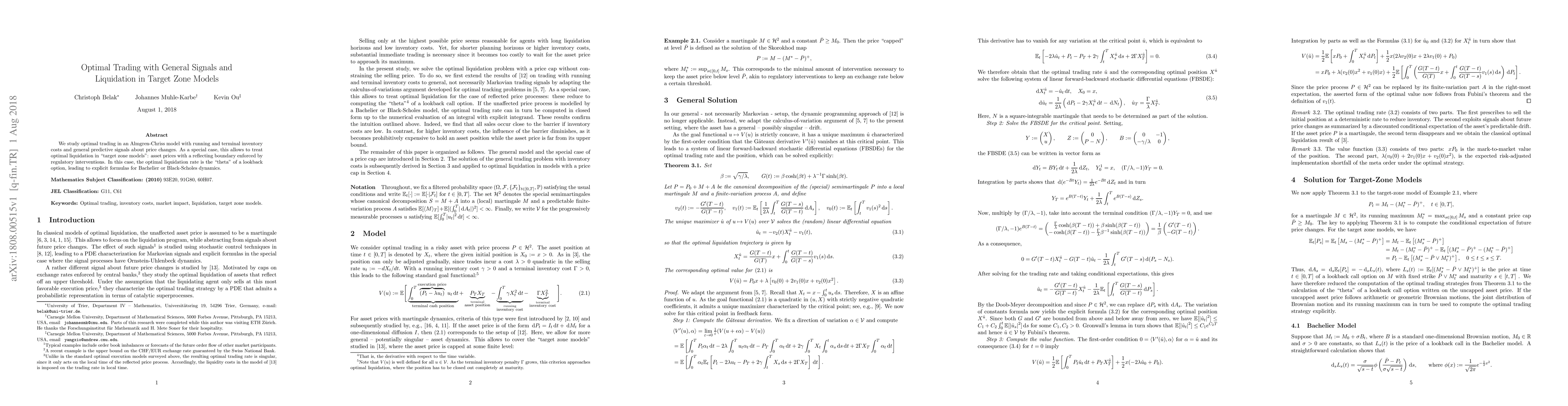

We study optimal trading in an Almgren-Chriss model with running and terminal inventory costs and general predictive signals about price changes. As a special case, this allows to treat optimal liquidation in "target zone models": asset prices with a reflecting boundary enforced by regulatory interventions. In this case, the optimal liquidation rate is the "theta" of a lookback option, leading to explicit formulas for Bachelier or Black-Scholes dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)