Summary

We show the application of an optimal transportation approach to estimate stochastic volatility process by using the flow that optimally transports the set of particles from the prior to a posterior distribution. We also show how to direct the flow to a rarely visited areas of the state space by using a particle method (a mutation and a reweighing mechanism). We demonstrate the efficiency of our approach on a simple example of the European option price under the Stein-Stein stochastic volatility model for which a closed form formula is available. Both homotopy and reweighted homotopy methods show a lower variance, root-mean squared errors and a bias compared to other filtering schemes recently developed in the signal-processing literature, including particle filter techniques.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research applies an optimal transportation approach using a flow that optimally transports particles from a prior to a posterior distribution, with a particle method (mutation and reweighing) to direct the flow to rarely visited areas of the state space.

Key Results

- The homotopy and reweighted homotopy methods show lower variance, root-mean squared errors, and bias compared to other filtering schemes, including particle filter techniques.

- The proposed method efficiently samples from high-dimensional, non-linear, and non-Gaussian filtering distributions, avoiding the explosion of sample size.

- Numerical tests on a Stein-Stein stochastic volatility model demonstrate significant reduction in variance and bias of the estimator with the proposed homotopy transport with particle reweighing algorithm.

Significance

This research contributes to the field of finance by providing efficient algorithms for estimating stochastic volatility processes, which are crucial for pricing options and managing financial risk.

Technical Contribution

The paper presents a novel homotopy transport algorithm with particle reweighing for optimal transport filtering, which improves estimation accuracy in finance applications.

Novelty

The approach combines optimal transport theory with particle filtering, introducing a reweighing mechanism to enhance exploration of the state space, especially in rarely visited regions.

Limitations

- The method may face challenges in very high-dimensional problems where importance weights do not converge to unity.

- The computational cost might be high for complex models or large datasets.

Future Work

- Investigating the application of the proposed method on non-Gaussian examples.

- Exploring solutions to address the issue of importance weight convergence in high-dimensional problems.

Paper Details

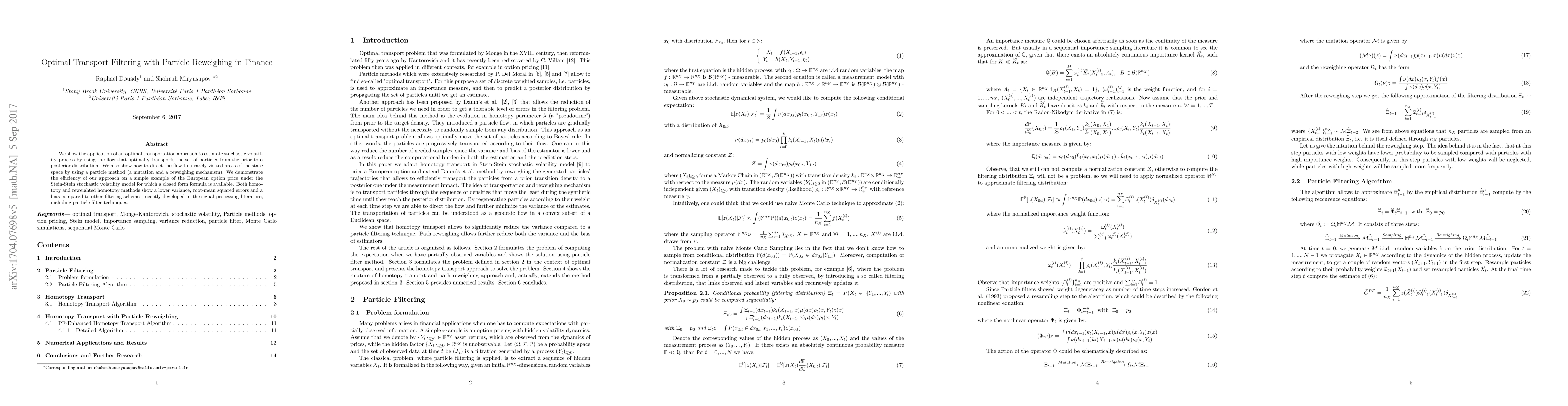

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Transport Particle Filters

Amirhossein Taghvaei, Mohammad Al-Jarrah, Bamdad Hosseini

Nonlinear Filtering with Brenier Optimal Transport Maps

Amirhossein Taghvaei, Mohammad Al-Jarrah, Bamdad Hosseini et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)