Summary

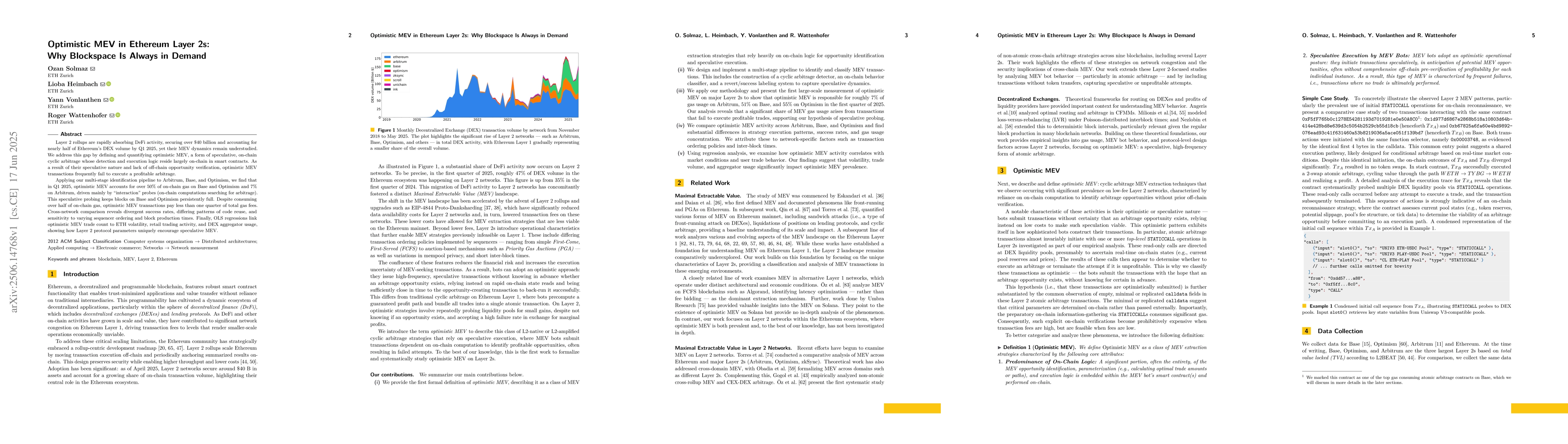

Layer 2 rollups are rapidly absorbing DeFi activity, securing over $40 billion and accounting for nearly half of Ethereum's DEX volume by Q1 2025, yet their MEV dynamics remain understudied. We address this gap by defining and quantifying optimistic MEV, a form of speculative, on-chain cyclic arbitrage whose detection and execution logic reside largely on-chain in smart contracts. As a result of their speculative nature and lack of off-chain opportunity verification, optimistic MEV transactions frequently fail to execute a profitable arbitrage. Applying our multi-stage identification pipeline to Arbitrum, Base, and Optimism, we find that in Q1 2025, optimistic MEV accounts for over 50% of on-chain gas on Base and Optimism and 7% on Arbitrum, driven mainly by "interaction" probes (on-chain computations searching for arbitrage). This speculative probing keeps blocks on Base and Optimism persistently full. Despite consuming over half of on-chain gas, optimistic MEV transactions pay less than one quarter of total gas fees. Cross-network comparison reveals divergent success rates, differing patterns of code reuse, and sensitivity to varying sequencer ordering and block production times. Finally, OLS regressions link optimistic MEV trade count to ETH volatility, retail trading activity, and DEX aggregator usage, showing how Layer 2 protocol parameters uniquely encourage speculative MEV.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRolling in the Shadows: Analyzing the Extraction of MEV Across Layer-2 Rollups

Cristina Nita-Rotaru, Ben Weintraub, Christof Ferreira Torres et al.

Who Wins Ethereum Block Building Auctions and Why?

Florian Matthes, Thomas Thiery, Burak Öz et al.

No citations found for this paper.

Comments (0)