Summary

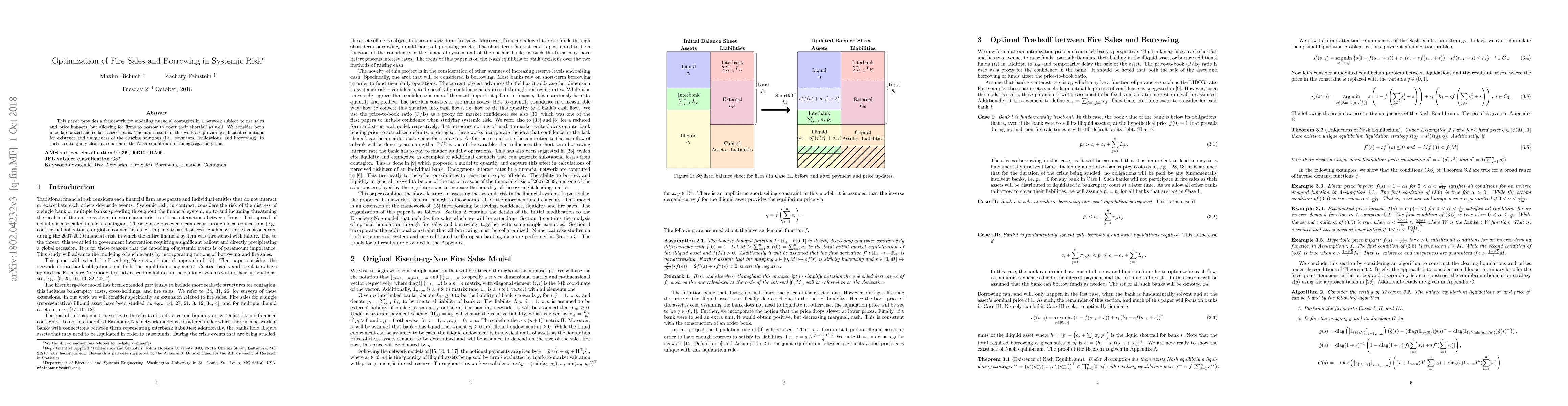

This paper provides a framework for modeling financial contagion in a network subject to fire sales and price impacts, but allowing for firms to borrow to cover their shortfall as well. We consider both uncollateralized and collateralized loans. The main results of this work are providing sufficient conditions for existence and uniqueness of the clearing solutions (i.e., payments, liquidations, and borrowing); in such a setting any clearing solution is the Nash equilibrium of an aggregation game.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPlaying with Fire? A Mean Field Game Analysis of Fire Sales and Systemic Risk under Regulatory Capital Constraints

Rüdiger Frey, Theresa Traxler

| Title | Authors | Year | Actions |

|---|

Comments (0)