Authors

Summary

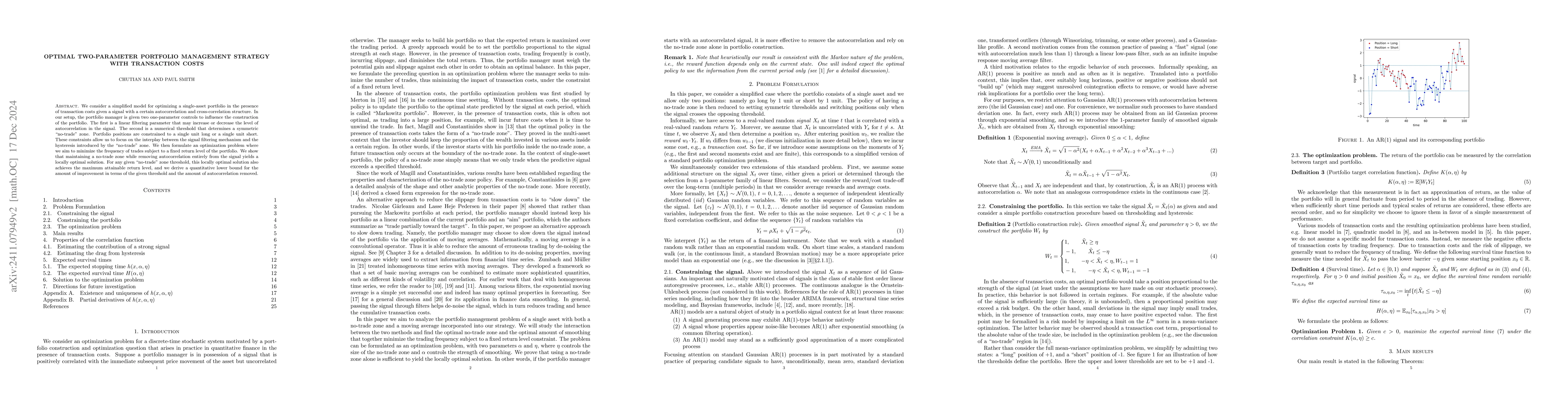

We consider a simplified model for optimizing a single-asset portfolio in the presence of transaction costs given a signal with a certain autocorrelation and cross-correlation structure. In our setup, the portfolio manager is given two one-parameter controls to influence the construction of the portfolio. The first is a linear filtering parameter that may increase or decrease the level of autocorrelation in the signal. The second is a numerical threshold that determines a symmetric ``no-trade" zone. Portfolio positions are constrained to a single unit long or a single unit short. These constraints allow us to focus on the interplay between the signal filtering mechanism and the hysteresis introduced by the ``no-trade" zone. We then formulate an optimization problem where we aim to minimize the frequency of trades subject to a fixed return level of the portfolio. We show that maintaining a no-trade zone while removing autocorrelation entirely from the signal yields a locally optimal solution. For any given ``no-trade" zone threshold, this locally optimal solution also achieves the maximum attainable return level, and we derive a quantitative lower bound for the amount of improvement in terms of the given threshold and the amount of autocorrelation removed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCompressed Newton-direction-based Thresholding Methods for Sparse Optimization Problems

Nan Meng, Yun-Bin Zhao

No citations found for this paper.

Comments (0)