Authors

Summary

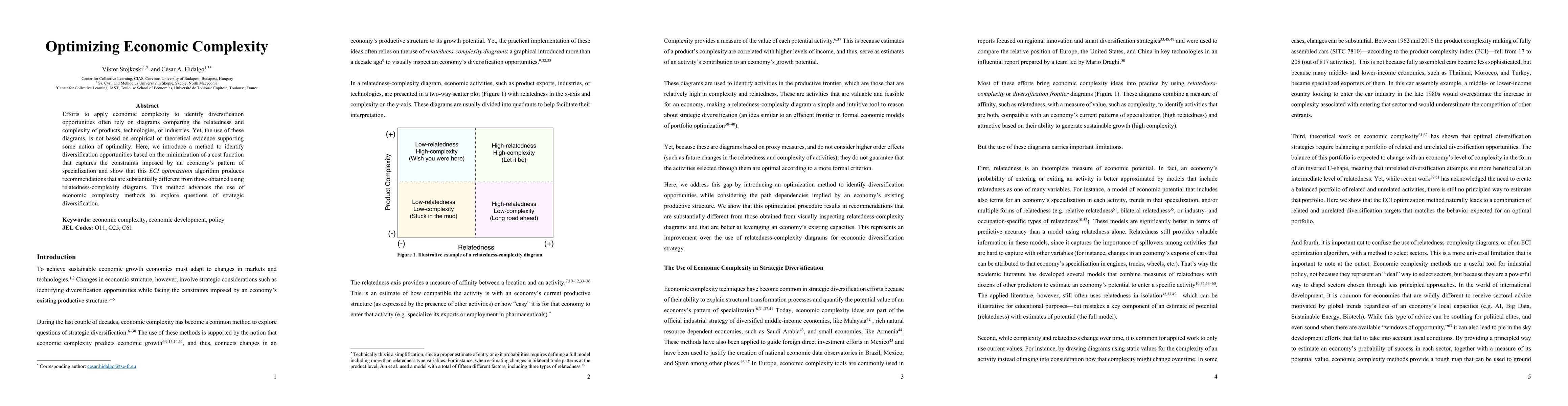

Efforts to apply economic complexity to identify diversification opportunities often rely on diagrams comparing the relatedness and complexity of products, technologies, or industries. Yet, the use of these diagrams, is not based on empirical or theoretical evidence supporting some notion of optimality. Here, we introduce a method to identify diversification opportunities based on the minimization of a cost function that captures the constraints imposed by an economy's pattern of specialization and show that this ECI optimization algorithm produces recommendations that are substantially different from those obtained using relatedness-complexity diagrams. This method advances the use of economic complexity methods to explore questions of strategic diversification.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces the ECI Optimization method, a structured approach to strategic diversification using a linear program to identify a portfolio of activities that achieve a target level of economic complexity with minimal cost, visualized in a cost-complexity diagram.

Key Results

- ECI Optimization method produces recommendations substantially different from relatedness-complexity diagrams.

- Method balances among related and unrelated activities following optimal diversification theory.

- Demonstrated practical application by suggesting activities optimizing desired economic growth rate for Thailand and Mexico.

Significance

This approach offers a mathematically rigorous alternative to traditional diversification strategies, equipping policymakers with a tool that balances complexity gains with practical feasibility in economic development efforts.

Technical Contribution

The ECI Optimization method provides a mathematically grounded approach for strategic diversification, advancing the policy toolkit of economic complexity.

Novelty

Distinct from existing methods relying on straightforward interpretations of relatedness-complexity diagrams, this method considers optimization aspects and changes in comparative advantages over time.

Limitations

- Risk of altering the patterns that ECI was originally designed to capture, potentially losing its effectiveness as a diagnostic tool.

- ECI is a 'philosophically positive' measure reflecting multiple underlying outcomes; applications should consider broader dynamics shaping these outcomes.

- Illustration based on a limited diversification model with few parameters and a simple linear model specification for the stepping stone function.

- Primarily considers a single dimension of economic activity, overlooking other crucial dimensions like technologies, research, and the digital economy.

- Does not fully account for general equilibrium effects, where multiple economies optimize simultaneously.

Future Work

- Explore benefits of using more comprehensive diversification models and specifications, including non-invertible functions.

- Investigate multidimensional aspects of economic complexity, encompassing product sophistication, technologies, research, and the digital economy.

- Develop a game-theoretic or agent-based extension of the framework to account for interdependencies in decision-making across countries.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCost Functions in Economic Complexity

Paolo Buttà, Vito D. P. Servedio, Alessandro Bellina

No citations found for this paper.

Comments (0)