Summary

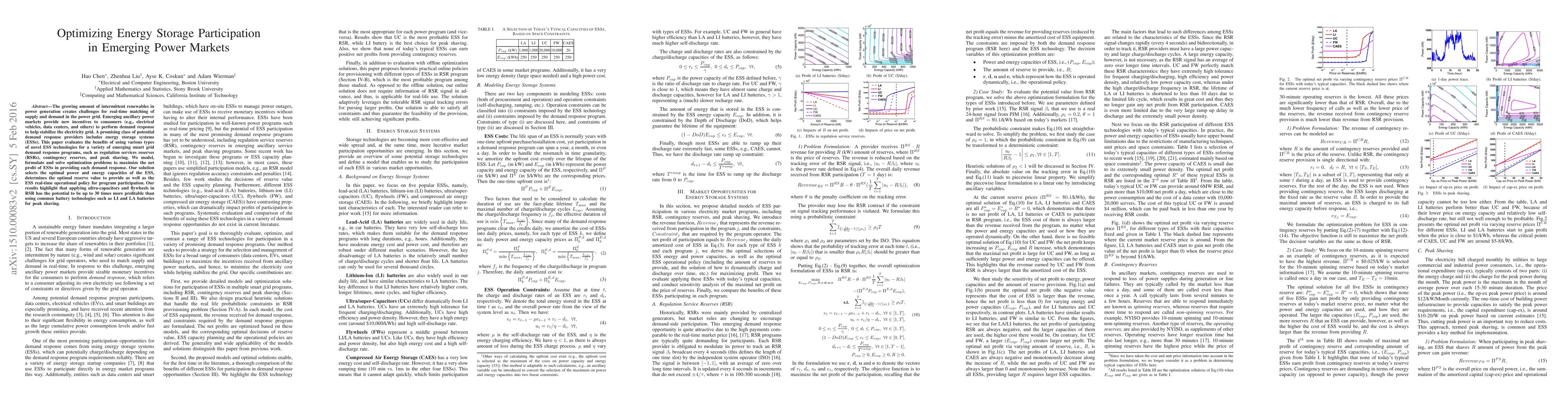

The growing amount of intermittent renewables in power generation creates challenges for real-time matching of supply and demand in the power grid. Emerging ancillary power markets provide new incentives to consumers (e.g., electrical vehicles, data centers, and others) to perform demand response to help stabilize the electricity grid. A promising class of potential demand response providers includes energy storage systems (ESSs). This paper evaluates the benefits of using various types of novel ESS technologies for a variety of emerging smart grid demand response programs, such as regulation services reserves (RSRs), contingency reserves, and peak shaving. We model, formulate and solve optimization problems to maximize the net profit of ESSs in providing each demand response. Our solution selects the optimal power and energy capacities of the ESS, determines the optimal reserve value to provide as well as the ESS real-time operational policy for program participation. Our results highlight that applying ultra-capacitors and flywheels in RSR has the potential to be up to 30 times more profitable than using common battery technologies such as LI and LA batteries for peak shaving.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Participation of Price-maker Battery Energy Storage Systems in Energy and Ancillary Services Markets Considering Degradation Cost

Meng Wu, Reza Khalilisenobari

Control Co-Design Under Uncertainty for Offshore Wind Farms: Optimizing Grid Integration, Energy Storage, and Market Participation

Wei Wang, Bowen Huang, Himanshu Sharma et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)