Summary

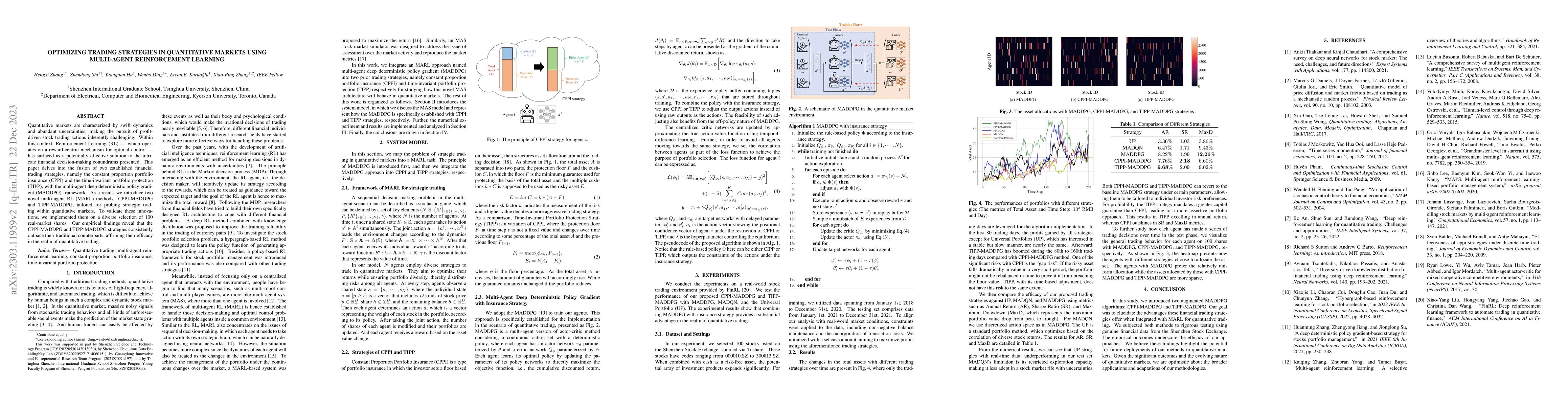

Quantitative markets are characterized by swift dynamics and abundant uncertainties, making the pursuit of profit-driven stock trading actions inherently challenging. Within this context, reinforcement learning (RL), which operates on a reward-centric mechanism for optimal control, has surfaced as a potentially effective solution to the intricate financial decision-making conundrums presented. This paper delves into the fusion of two established financial trading strategies, namely the constant proportion portfolio insurance (CPPI) and the time-invariant portfolio protection (TIPP), with the multi-agent deep deterministic policy gradient (MADDPG) framework. As a result, we introduce two novel multi-agent RL (MARL) methods, CPPI-MADDPG and TIPP-MADDPG, tailored for probing strategic trading within quantitative markets. To validate these innovations, we implemented them on a diverse selection of 100 real-market shares. Our empirical findings reveal that the CPPI-MADDPG and TIPP-MADDPG strategies consistently outpace their traditional counterparts, affirming their efficacy in the realm of quantitative trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)