Summary

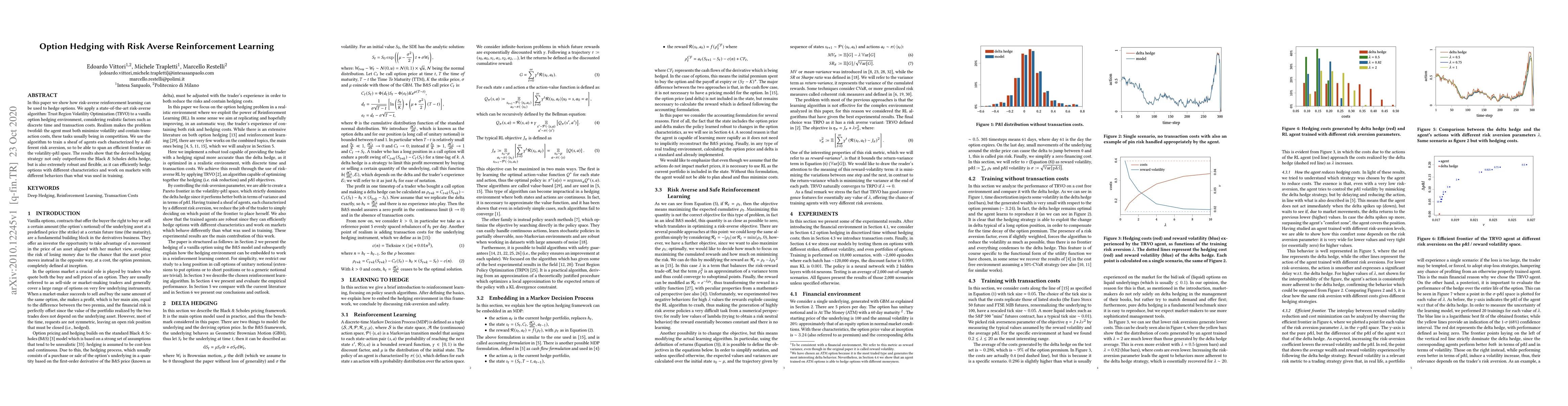

In this paper we show how risk-averse reinforcement learning can be used to hedge options. We apply a state-of-the-art risk-averse algorithm: Trust Region Volatility Optimization (TRVO) to a vanilla option hedging environment, considering realistic factors such as discrete time and transaction costs. Realism makes the problem twofold: the agent must both minimize volatility and contain transaction costs, these tasks usually being in competition. We use the algorithm to train a sheaf of agents each characterized by a different risk aversion, so to be able to span an efficient frontier on the volatility-p\&l space. The results show that the derived hedging strategy not only outperforms the Black \& Scholes delta hedge, but is also extremely robust and flexible, as it can efficiently hedge options with different characteristics and work on markets with different behaviors than what was used in training.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCVA Hedging by Risk-Averse Stochastic-Horizon Reinforcement Learning

Roberto Daluiso, Marco Pinciroli, Michele Trapletti et al.

A Risk Sensitive Contract-unified Reinforcement Learning Approach for Option Hedging

Yi Wu, Xiang Zhou, Bo Xiao et al.

Option Dynamic Hedging Using Reinforcement Learning

Can Yang, Cong Zheng, Jiafa He

| Title | Authors | Year | Actions |

|---|

Comments (0)