Summary

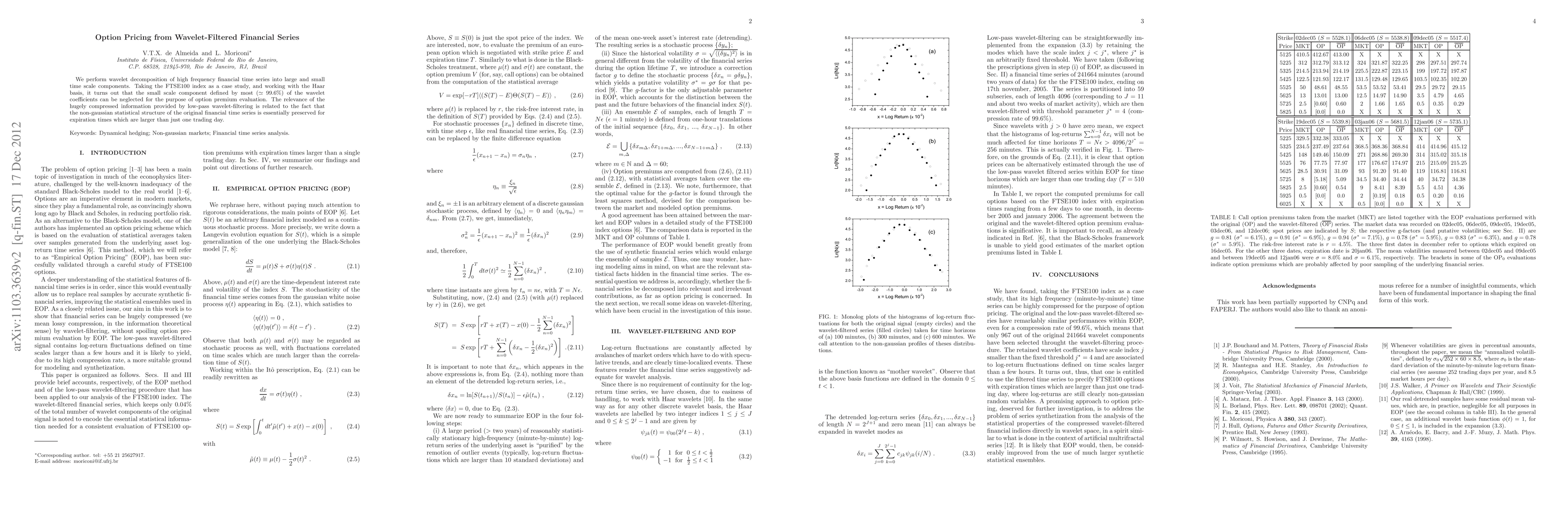

We perform wavelet decomposition of high frequency financial time series into large and small time scale components. Taking the FTSE100 index as a case study, and working with the Haar basis, it turns out that the small scale component defined by most ($\simeq$ 99.6%) of the wavelet coefficients can be neglected for the purpose of option premium evaluation. The relevance of the hugely compressed information provided by low-pass wavelet-filtering is related to the fact that the non-gaussian statistical structure of the original financial time series is essentially preserved for expiration times which are larger than just one trading day.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime series generation for option pricing on quantum computers using tensor network

Koichi Miyamoto, Nozomu Kobayashi, Yoshiyuki Suimon

| Title | Authors | Year | Actions |

|---|

Comments (0)