Summary

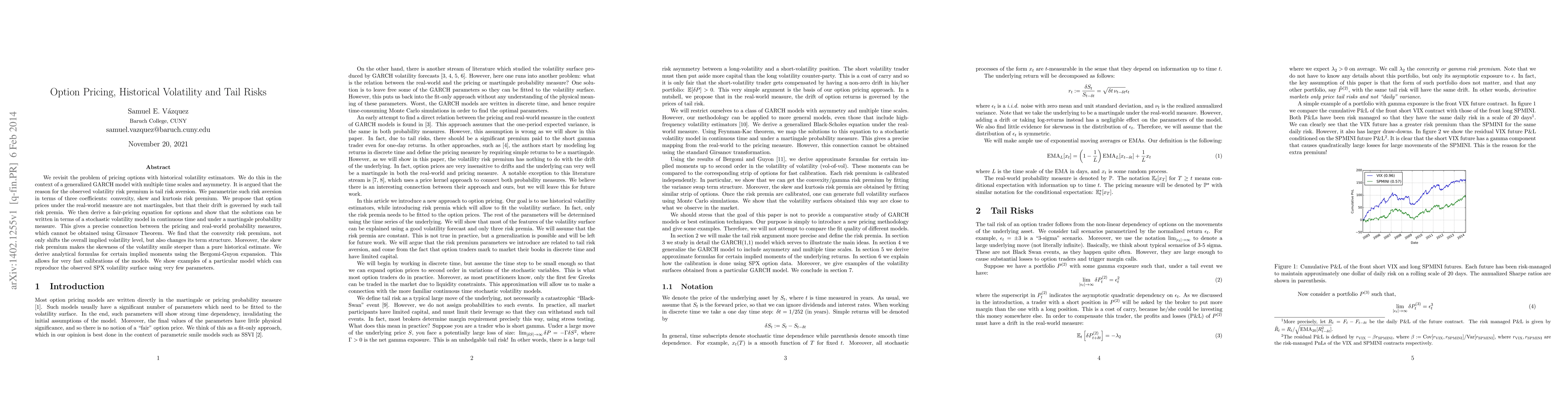

We revisit the problem of pricing options with historical volatility estimators. We do this in the context of a generalized GARCH model with multiple time scales and asymmetry. It is argued that the reason for the observed volatility risk premium is tail risk aversion. We parametrize such risk aversion in terms of three coefficients: convexity, skew and kurtosis risk premium. We propose that option prices under the real-world measure are not martingales, but that their drift is governed by such tail risk premia. We then derive a fair-pricing equation for options and show that the solutions can be written in terms of a stochastic volatility model in continuous time and under a martingale probability measure. This gives a precise connection between the pricing and real-world probability measures, which cannot be obtained using Girsanov Theorem. We find that the convexity risk premium, not only shifts the overall implied volatility level, but also changes its term structure. Moreover, the skew risk premium makes the skewness of the volatility smile steeper than a pure historical estimate. We derive analytical formulas for certain implied moments using the Bergomi-Guyon expansion. This allows for very fast calibrations of the models. We show examples of a particular model which can reproduce the observed SPX volatility surface using very few parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)