Summary

In this paper, we consider option pricing in a framework of the fractional Heston-type model with $H>1/2$. As it is impossible to obtain an explicit formula for the expectation $\mathbb E f(S_T)$ in this case, where $S_T$ is the asset price at maturity time and $f$ is a payoff function, we provide a discretization schemes $\hat Y^n$ and $\hat S^n$ for volatility and price processes correspondingly and study convergence $\mathbb E f(\hat S^n_T) \to \mathbb E f(S_T)$ as the mesh of the partition tends to zero. The rate of convergence is calculated. As we allow $f$ to have discontinuities of the first kind which can cause errors in straightforward Monte-Carlo estimation of the expectation, we use Malliavin calculus techniques to provide an alternative formula for $\mathbb E f(S_T)$ with smooth functional under the expectation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

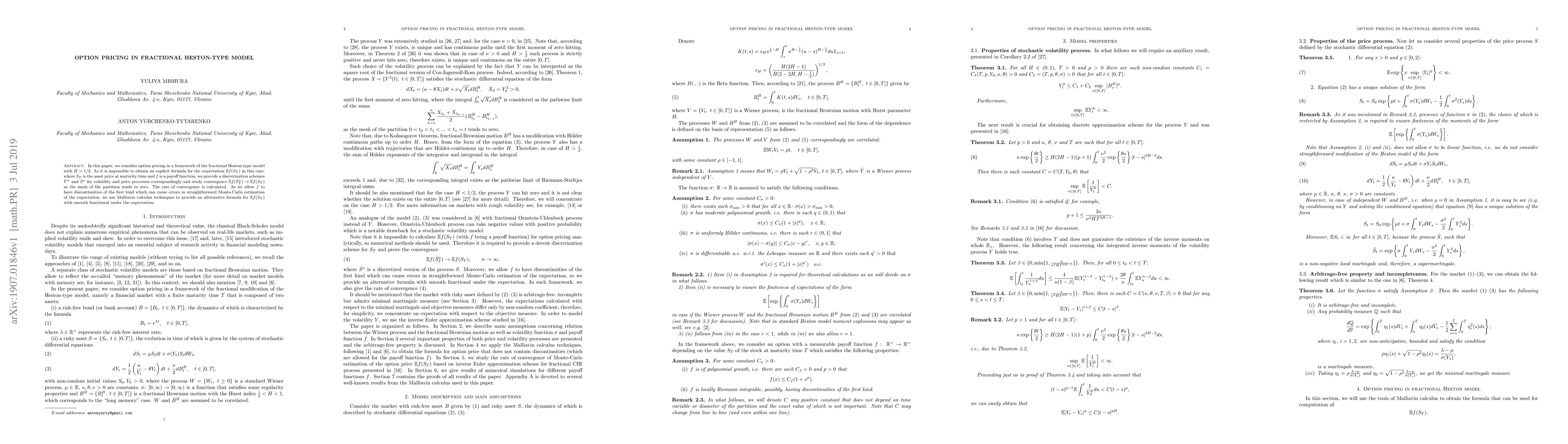

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)