Summary

The objective of this paper is to introduce the theory of option pricing for markets with informed traders within the framework of dynamic asset pricing theory. We introduce new models for option pricing for informed traders in complete markets where we consider traders with information on the stock price direction and stock return mean. The Black-Scholes-Merton option pricing theory is extended for markets with informed traders, where price processes are following continuous-diffusions. By doing so, the discontinuity puzzle in option pricing is resolved. Using market option data, we estimate the implied surface of the probability for a stock upturn, the implied mean stock return surface, and implied trader information intensity surface.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

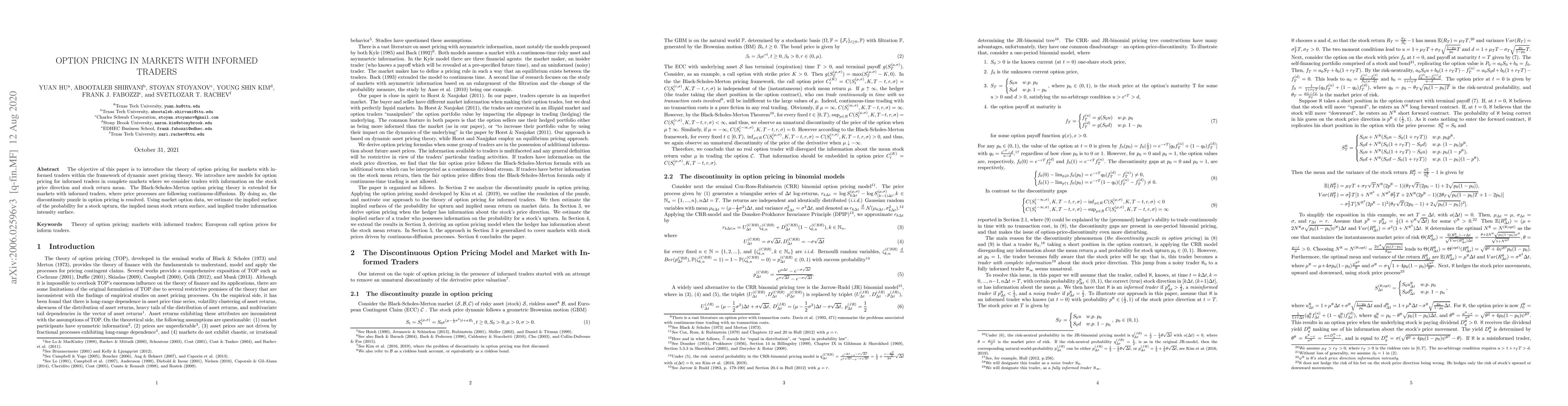

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)